Total enquiries for offices over 5,000 sq. ft in Q3 2018 were 100, comparable with the total of 102 in Q3 2017, but slightly more than the total of 90 from Q2 2018.

Take up in the Thames Valley office market over 5,000 sq. ft in Q3 totalled 508,540 sq. ft, compared with 300,675 sq. ft in same quarter last year, showing a comparative increase of 69% between the two quarters. The Q3 total was also considerably more than the previous Q2 2018 which stood at 342,022 sq ft.

Take up in the Thames Valley office market over 5,000 sq. ft in Q3 totalled 508,540 sq. ft, compared with 300,675 sq. ft in same quarter last year, showing a comparative increase of 69% between the two quarters. The Q3 total was also considerably more than the previous Q2 2018 which stood at 342,022 sq ft.

Office enquiries levels stable

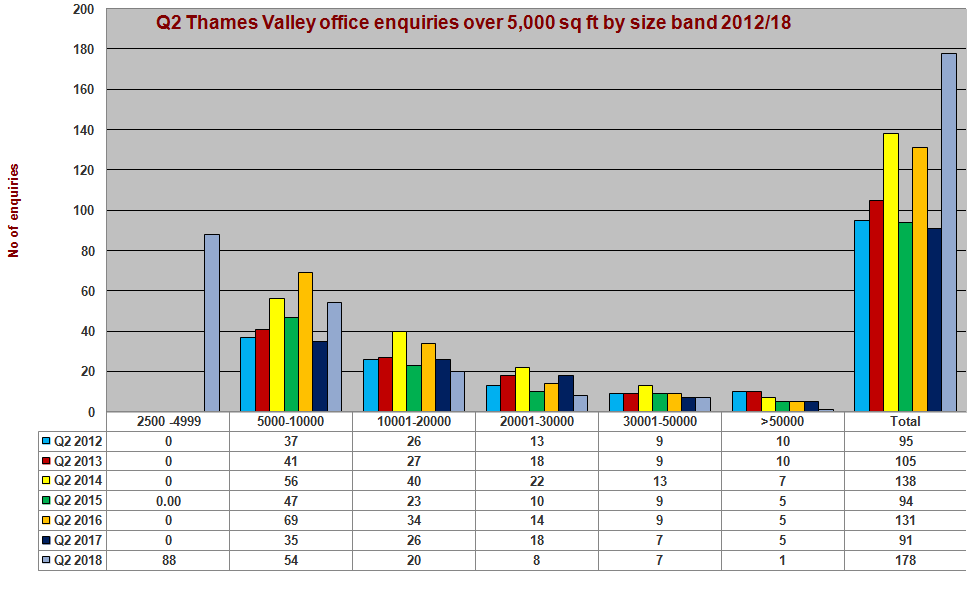

Total enquiries for offices over 5,000 sq ft in Q2 2018 were 90, comparable with the total of 91 in Q2 2017, but less than the total of 136 from Q1 2018.

There were less enquiries for offices over 20,000 sq ft in Q2 2018 compared with Q2 2017, 16 verses 30.

Q2 2018 smaller enquiries for space between 2,500 and 5,000 sq ft in Q2 2018 totalled 88 compared to 74 in Q1 2018.

Take up down

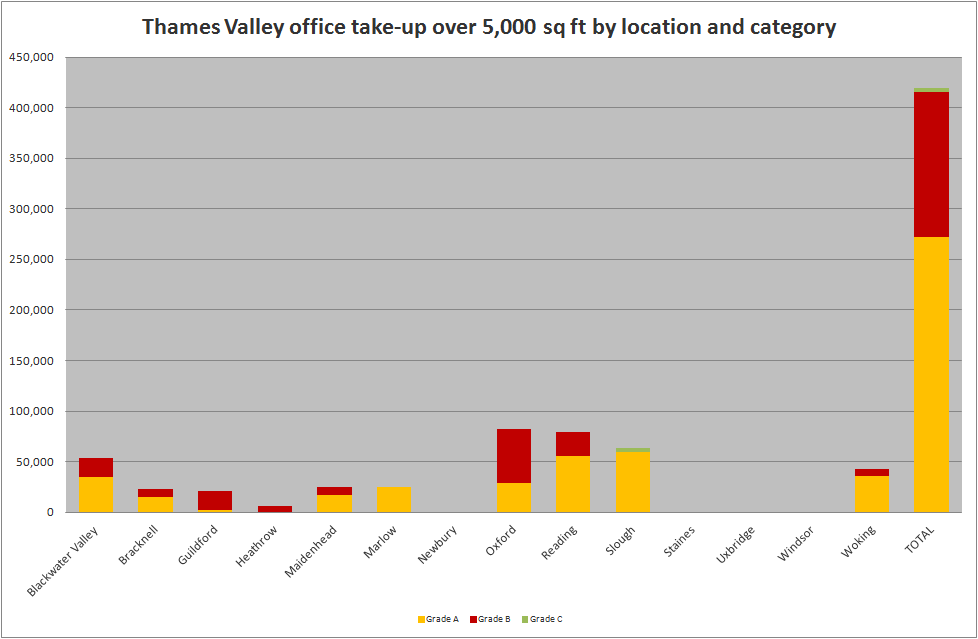

Take up in the Thames Valley office market over 5,000 sq ft in Q2 totalled 342,022 sq ft, compared with 524,254 sq ft in same quarter last year, showing a comparative fall of 35% between the two quarters.

Total take up for the first 6 months of 2018 is 699,802 sq ft compared with 954,806 in the same period in 2017. This shows a comparative fall of 27%.

65% of total take up was grade A stock in Q2 2018 compared to 78% in Q1 and 61% in Q2 2017. The most active sectors were TMT 32%, Serviced Offices 23% and Pharmaceuticals 19%.

There was 62,000 sq ft of take up in the 2,500/5,000 sq ft range which we have started tracking from Q1 2018 (73,106 sq ft).

significant occupational transactions

| Property | Size (sq ft) | Landlord | Tenant | Rent (per sq ft) | Lease (years) |

| Woking One, Woking | 35,885 | Wrenbridge | Regus | £32.00 | 10 |

| The Porter Building, Slough | 30,000 | Landid/Brockton | Spaces | £34.75 | 10 |

| Building One - Abingdon Business Park, Abingdon | 28,600 | TH Real Estate | HEREF Emperor | £20.75 | 10 |

| Spires House, Oxford | 25,887 | HEREF Emperor | Jazz Pharmaceuticals | £33.00 | 10 |

| 1 Globeside, Maidenhead | 36,796 | Threadneedle | Amicus | £28.00 | 10 |

| 10 Watchmoor Park, Camberley | 22,500 | Frasers Centerpoint | Jenoptik | £22.00 | 10 |

| R+, Reading | 19,584 | M&G | Moore Stephens | £37.50 | 10 |

| 1 Occam Court, Guildford | 18,663 | University of Surrey | Prime Vigilance | £26.50 | 10 |

| The Future Works, Slough | 16,700 | U&I Group | Central Working | Managed | 15 |

| Pinehurst II, Farnborough | 14,410 | Frasers Centerpoint | INC research | £27.00 | 9 |

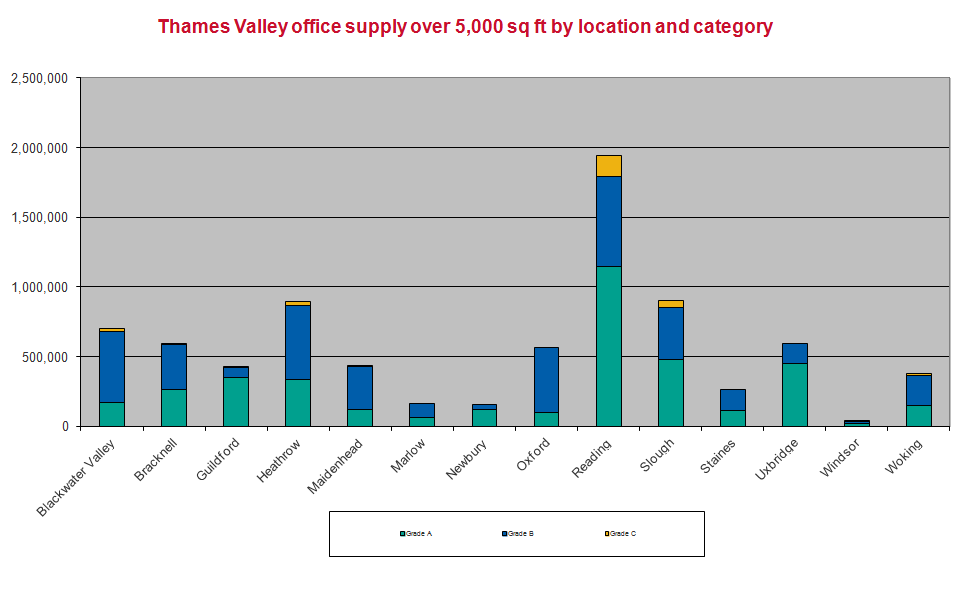

Office supply is steadily falling

Total office supply in the Thames Valley now stands at 8.07m sq ft, a fall of 5% since Q2 2017.

48% of current supply is grade A stock compared to 53% at the end of Q2 last year.

There is a need for new development/refurbishment projects to feed the supply chain in 2019.

Investment market review - Decrease in activity in Q2

Q2 2018 saw a decrease in activity volumes totalling £248m (Q1: £434m) with just 14 transactions in total at an average lot size of £17m. This reflects a return to a more representative average transaction size for the region, following a number of large deals in Q1 pushing it up to £42m.

The balance between the out of town and town centre market was spread fairly equal with £134m and £114m transacted respectively, reflecting the diversity and depth of investor demand in the Thames Valley.

We anticipate to see further activity during the course of the summer providing vendor and purchaser expectations a line, with 15 properties totalling £256m currently being marketed across the Thames Valley region.

key investment deals

The White Building, Reading

Aberdeen Standard purchased the asset from Boultbee Brooks Real Estate for £51m, reflecting a net initial yield 5.75%. The building was multi-let located within Reading Town Centre.

Volvo HQ, Maidenhead

Runnymede Borough Council has purchased Volvo HQ for £12m from a private investor, reflecting a yield of 5.33%. The building was let in its entirety to Volvo with 9 years unexpired.

3 Arlington Square, Bracknell

Orchard Street Investment Management purchased 3 Arlington for £22.65m. This multi-let building totalled 67,376 sq ft and achieved net capital value of £336 per sq f, reflecting a net initial yield of 6.25%.

Pinetrees, Staines

Runneymede Borough Council has acquired Pine Trees complex for £80.7m from Aberdeen Standard. The five building is leased to tenants such as Bupa and the UK Accreditation service.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email