Q1 2018 saw a healthy level of transactional volumes totalling £434m, being a 53% increase from Q4 2017. There were a total of 15 transactions and an average lot size of £31m. This average lot size is considerably higher than the £17m of Q4, which is a result of 3 of these transactions being over £50m.

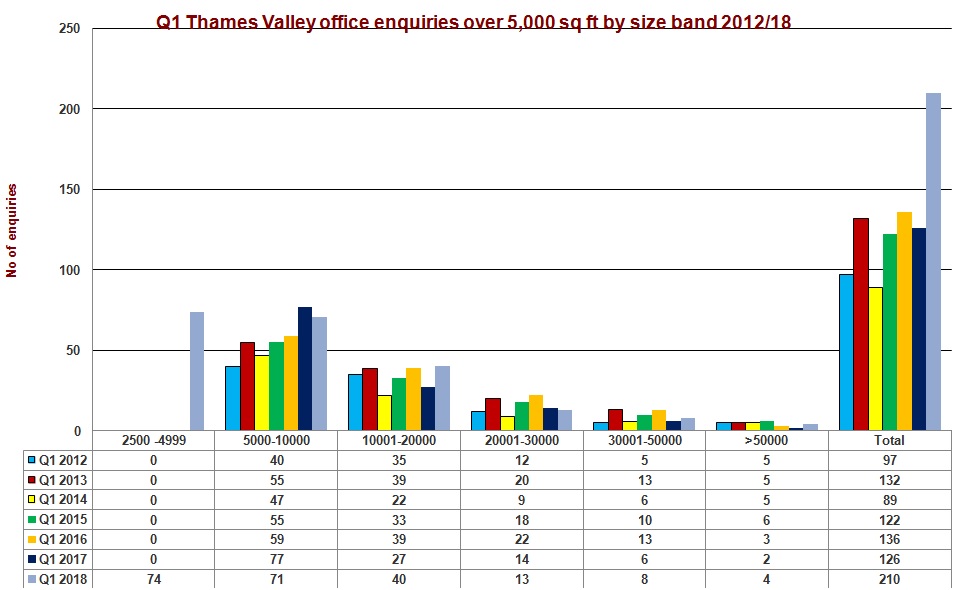

Enquiry levels at the highest for 6 years

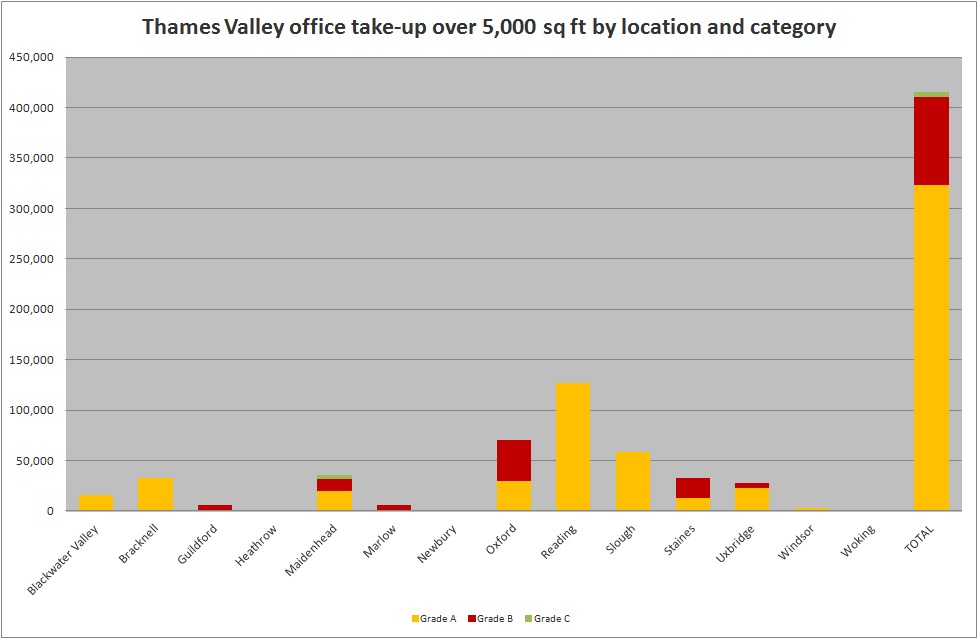

Demand is steady and Reading leads the way

significant occupational transactions

| Property | Size (sq ft) | Landlord | Tenant | Rent (per sq ft) | Lease (years) |

| 270 Bath Road, Slough | 48,915 | AEW | Stanley Black & Decker | TBC | 10 |

| Thames Tower, Reading | 37,530 | Landid/Brockton | Ericsson | £38.00 | 10 |

| Thames Tower, Reading | 27,589 | Landid/Brockton |

Fora | Base rent + turnover top up | Undisclosed |

| Belmont, Uxbridge | 23,000 | Aviva | Giff Gaff | £33.00 | 10 |

| Tor, Maidenhead | 20,000 | Rockspring/Blackrock | Lane 4 Management | TBC | 10 |

| Schrodinger Building, Oxford Science Park |

17,255 | Magdalen College Oxford | OSI | £32.00 | 15 |

| R+, Reading | 16,071 | M&G | Central Working | Base rent + turnover top up | 15 |

| Thames Tower, Reading | 14,040 | Landid/Brockton | MBNL | £35.00 | 10 |

| 20 Kingston Road, Staines | 14,000 | M&G | Imtech | £32.00 | 10 |

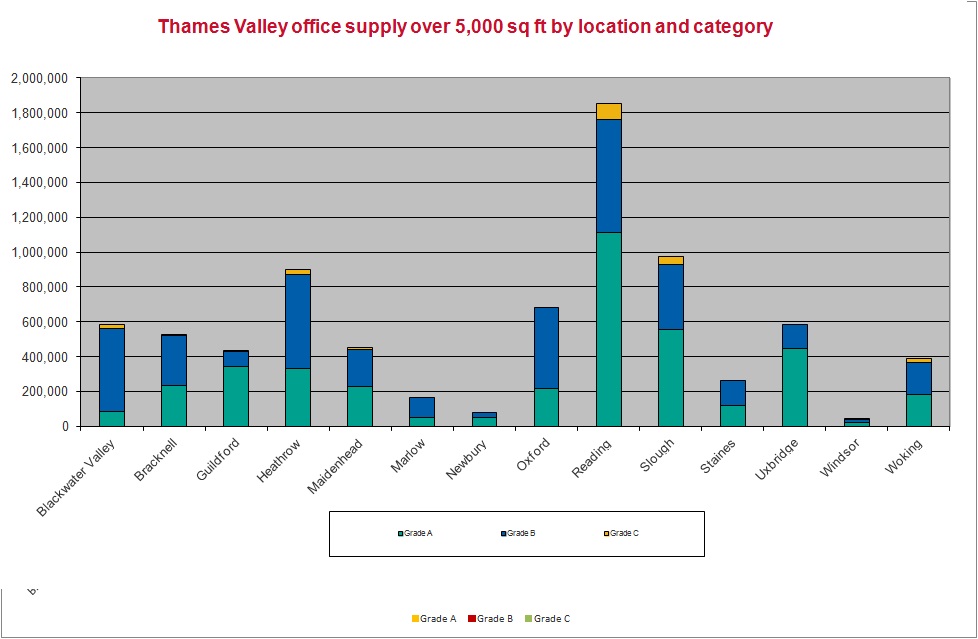

office supply remains stable

Investment market review

Q1 2018 saw a healthy level of transactional volumes totalling £434m, being a 53% increase from Q4 2017. There were a total of 15 transactions and an average lot size of £31m. This average lot size is considerably higher than the £17m of Q4, which is a result of 3 of these transactions being over £50m.

The out of town market outweighed the town centre market with £266m transacted in comparison £117m transacted, giving confidence in the out of town market. The average WAULT for transactions during the quarter was 4.66 years, when compared with 5.10 years in Q4 2017, demonstrates a consistent level of risk appetite by investors.

There are currently 13 properties being actively marketed across the Thames Valley region, totalling £218m and with £132m currently exchanged or under offer, Q2 is looks like it will be a steady quarter in line with Q1 figures.

key investment deals

Farnborough Business Park, Farnborough

Frasers Centerpoint have purchased Farnborough Business Park for £175mm from XLB / Harbert, reflecting a yield of 6.78%. The park has a WUALT of 5.8 years and 36 tenants.

Harman House, Uxbridge

CLS purchased Harman House from Pramerica for £51m. This multi-let building totalled 130,000 sq ft and achieved net capital value of £392 per sq f, reflecting a net initial yield of 6.31%.

1 Longwalk, Stockley Park

A private investor purchased the asset from RREEF Special Invest for £30m, being above quoting reflecting a net initial yield of 6.7% and net capital value of £400 per sq ft.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email