BUDGET 2025: WHAT IT MEANS FOR PROPERTY, REGENERATION, AND INVESTMENT

The Chancellor’s 2025 Budget marks a turning point for the UK property market and regional growth. While new tax measures tighten the fiscal screws on high-value assets and landlords, significant investment in infrastructure, housing, and skills creates opportunities for regeneration and economic development. Here’s what this means for our clients, and how strategies should evolve.

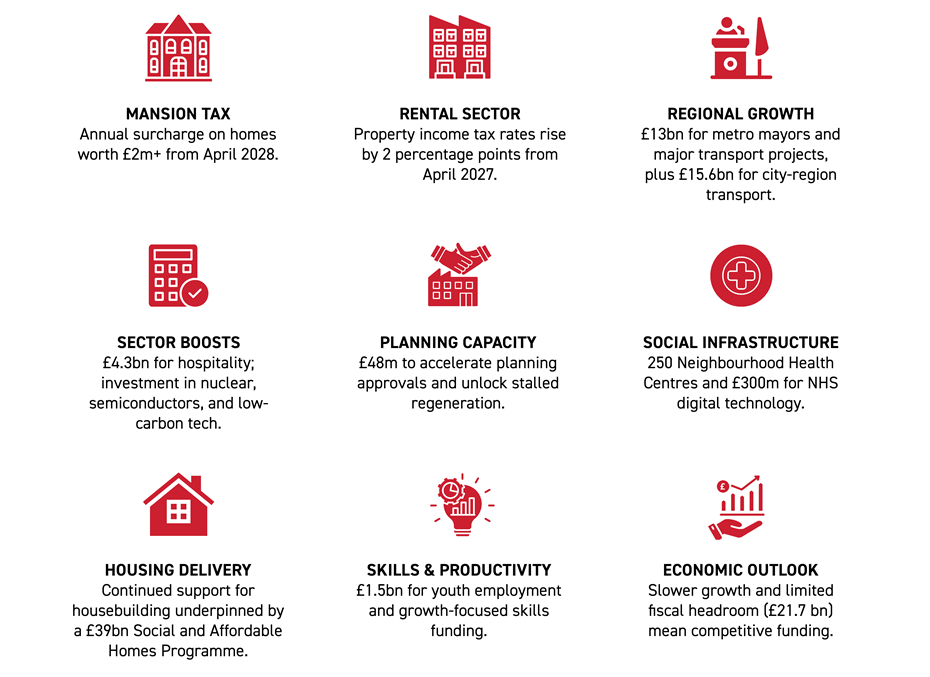

AT A GLANCE – KEY IMPACTS

Budget Fact: Homes worth £2m+ will pay an annual council tax surcharge from April 2028.

Dubbed the “mansion tax,” this measure is expected to raise £400m a year but will reshape the economics of prime residential development. Developers and investors should factor these costs into feasibility models and consider whether the luxury market remains viable. We may see behavioural shifts such as downsizing or splitting large estates to stay below the threshold.

Budget Fact: Property income tax rates increase by two percentage points from April 2027.

This change will squeeze net yields, especially for smaller landlords, potentially triggering disposals or restructuring. Institutional landlords may absorb the impact, but proactive planning is essential. For LSH clients, this means reviewing portfolio strategies now to protect returns.

REGIONAL INVESTMENT: OPPORTUNITIES AMID FISCAL TIGHTENING

Budget Fact: £13bn in flexible funding for metro mayors and major transport infrastructure, including the Lower Thames Crossing and Midlands Rail Hub.

While property tax changes present challenges, the Budget also brings good news for regeneration. Funding for metro mayors and infrastructure projects will unlock growth corridors and improve connectivity, creating fertile ground for mixed-use developments and commercial property schemes. MHCLG confirms that metro mayor funding will prioritise brownfield development and affordable housing delivery, alongside Levelling Up Partnerships to drive local growth.

Business rates retention pilots extended to 2029 and the Leeds’ new 25-year retention zone signal strong regional opportunities.

This will help assist the previously announced £5bn Pride in Place programme, empowering communities to regenerate public spaces, high streets, and community assets.

HOUSING DELIVERY AND PLANNING REFORM

Budget Fact: £48m funding to boost capacity and capability.

According to economic forecasts, planning reforms introduced in Autumn 2024 are expected to deliver 170,000 additional homes and add 0.2% to GDP by 2029–30. The Budget 2025 continued to support this with £48m for planning capacity in addition to the £39bn Social and Affordable Homes Programme announced earlier in the year, supporting brownfield development and affordable housing delivery.

Developers and regeneration partners should act quickly to benefit from improved delivery timelines. This funding is coupled with a renewed focus on unlocking brownfield sites, accelerating approvals for housing and mixed-use schemes.

SECTOR-SPECIFIC BOOSTS

Budget Fact: £4.3bn support for hospitality and leisure sectors; targeted investments in nuclear power, semiconductors, and low-carbon technologies.

High streets will benefit from a national licensing framework and targeted support, while energy and technology sectors receive significant backing. Nuclear expansion in Anglesey, semiconductor investment in Wales (creating 8,000 jobs), and low-carbon technology funding in Grangemouth will drive demand for industrial and commercial property. These initiatives create new avenues for advisory and development work.

Initiatives such as the funding for playgrounds and greens spaces reinforces the regeneration narrative and links to placemaking strategies. The Mayoral Recycling Growth Fund is designed to boost circular economy and sustainability in local areas. Whilst indirect, it supports economic development by creating green jobs and improving environmental credentials, which are important for ESG-focused regeneration projects.

Skills and Workforce Development: Over £1.5bn is allocated to youth employment and skills programmes, including the Youth Guarantee. These measures underpin regeneration by ensuring local labour markets can support new developments and industrial clusters.

NHS NEIGHBOURHOOD HEALTH CENTRES

Budget Fact: 250 new Neighbourhood Health Centres to be delivered by 2030 through a mix of public investment and public–private partnerships, along with £300 m for digital NHS technology.

These “one-stop shop” health hubs, housing GPs, nurses, dentists, pharmacists, and community teams, are focused on deprived areas and high-need patients. This shift supports community-led regeneration by repurposing existing estate and constructing new facilities. Mixed-use developments with integrated health amenities are now viable components of regeneration masterplans. These health hubs form part of a wider social infrastructure strategy, complementing investment in schools and community facilities to support place-based regeneration.

Check our previous viewpoint on NHS Neighbourhood Health Centres here.

THE ECONOMIC BACKDROP

Budget Fact: OBR forecasts slower growth through 2029 and limited fiscal headroom (£21.7 billion).

Growth for 2024 has been revised up to 1.5%, but the longer-term outlook remains subdued. With borrowing set to fall yet debt staying high at 96% of GDP, public funding for regeneration will be competitive. Projects must demonstrate strong returns and leverage private investment to succeed.

WHAT SHOULD CLIENTS DO NOW?

- Developers: Build the mansion tax into feasibility models and consider pivoting toward mid-market housing.

- Landlords: Review portfolios in light of higher tax rates; consider restructuring or exiting non-core assets.

- Investors: Target regions benefiting from infrastructure and industrial investment.

- Regeneration Partners: Leverage planning capacity funding, NHS health hubs, and skills programmes. Position social impact and ESG at the core of project proposals.

IN SUMMARY

Budget 2025 introduces both challenges and opportunities. Wealth taxation reshapes parts of the property market, but regional investment, housing delivery, and skills funding create new growth prospects. Success will depend on proactive planning, strategic alignment with growth priorities, and robust financial modelling.

HOW LSH CAN HELP

At LSH, we work with clients to navigate complex market shifts. From feasibility modelling to identifying regeneration opportunities and structuring funding strategies, our team provides tailored advice to help you stay ahead. Contact us to discuss how Budget 2025 affects your portfolio and projects.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email