Consumers are placing ever greater demands on the UK’s cold chain infrastructure, stimulating growth and change in this important sector. Investors and developers are taking note, aided by the role out of new technologies.

A complex chain

Open the fridge-freezer and what you see is the final destination of an often complex yet seamless logistical process. Together with the chilled transportation network, the UK’s cold chain infrastructure plays a vital role in the processing, manufacture, storage and distribution of perishable goods. Food dominates, but other sectors such as the pharmaceuticals industry contribute to demand.

The nature of these facilities varies according to their intended use. Their location can be governed by either proximity to the produce or to the consumer, when the produce is ready for consumption after processing. The required temperature is also a key point of difference, ranging from highly bespoke frozen storage through to the varying degrees of chilled.

Given the typically bespoke nature of chilled operations and high associated build costs, property investors and developers have traditionally kept their distance from the sector. But this is changing, reflecting the outlook for growth in the cold chain, the increasing importance of sustainability (alongside the growing amount of obsolescence) and improvements in building techniques.

Crucial as the cold chain is, the physical extent of the sector is difficult to quantify with certainty. According to the UK Cold Chain Federation, its members occupy some 450 cold storage facilities around the UK. With another 200 or so in operation outside of its membership, total UK cold chain floorspace is estimated in to be in the region of 120m to 130m sq ft.

Cold calling

While the cold chain has long existed, the demands on it are increasing. This largely reflects consumers’ growing appetite for frozen and fresh food produce, particularly pre-prepared meals, while an increasing share of demand via online delivery is also fuelling growth. COVID-19 and Brexit have also brought a greater focus on the cold chain, with capacity tested to its limits last year. According to Kantar, the value of the UK frozen food sector increased by a massive 15% during 2020 alone.

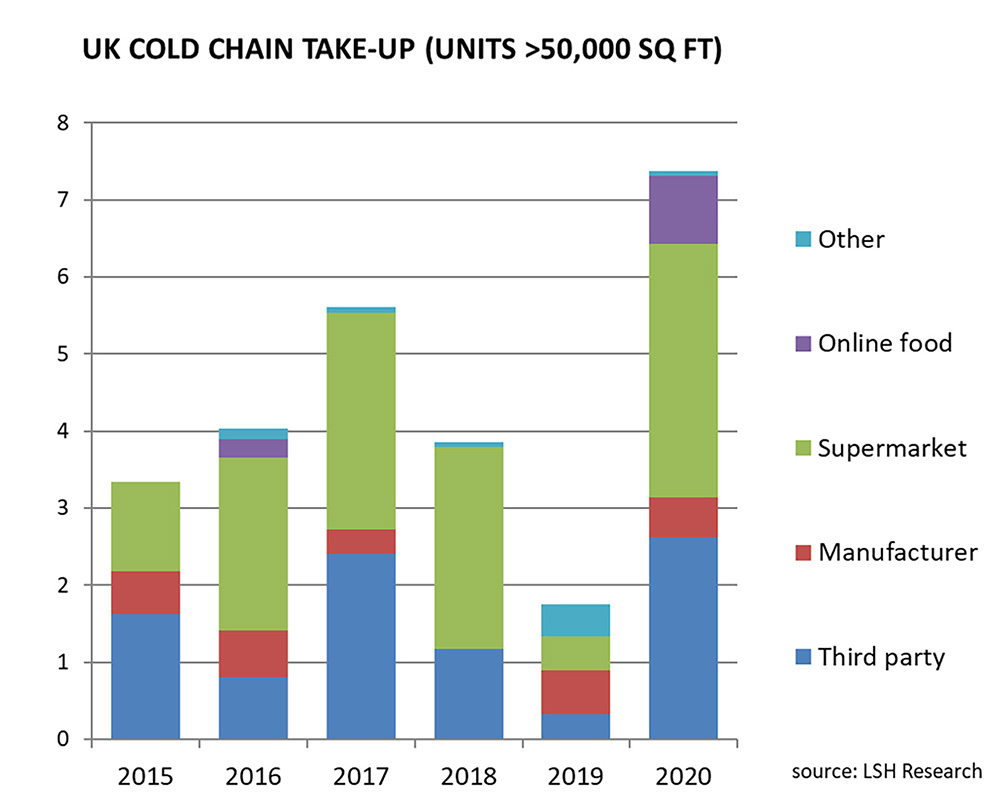

Growth in demand has been clearly reflected in the market. UK-wide take-up involving cold storage hit 7.2m sq ft in 2020, almost twice the annual average for the previous five years and equivalent to 12% of the whole market. Moreover, some 4.7m sq ft of 2020’s take-up involved either newly built or bespoke built to suit deals, a clear reflection of the expansion of demand over and above existing supply.

The breakdown of take-up in 2020 also speaks volumes about the increasing dynamism in the sector. Demand is increasing from emerging players in the food space, with notable deals in 2020 to the likes of Gousto, Hello Fresh and Butternut Box. Meanwhile, following a flurry of M&A activity, established third party operators are gaining a foothold, offering their services and facilities to the major supermarket retailers. Major players include GIST, Bidvest, Lineage, Oakland International, Culina Group and NewCold, the latter of which forward purchased land for a 638,000 sq ft facility in Corby last year.

Box within a box

Where cold facilities are not purpose-built, the conventional approach is to retro-fit an existing building with the necessary materials to insulate and control the required temperature. This ‘box within a box’ approach works well for landlords, as the fit-out can be removed at the end of the lease its life without materially impacting on the original building.

A notable deal last year was Gousto’s lease of Chillbox, Essex (196,000 sq ft). In this case, the building’s owner CBREGi opted to retain the cold plant used by the previous occupier after vacating the building. The fact that an institutional buyer chose to market the building specifically to cater for the cold chain is a telling sign of the increasing occupier demand and limited capacity in the sector.

Raise the bar and raise the appeal

Until recently, speculative development of chilled facilities has not taken place owing to the highly bespoke nature of demand from one cold chain user to the next. However, thanks to advances in building technology, investors and developers are starting to get more directly involved, developing buildings that can be pitched directly to the cold chain market as well as regular users of warehouses.

One key example is Nuneaton230 at Bermuda Park in the West Midlands. Its developer, Goodman, opted to include an advanced form of cladding (CA Twin-Therm® Chronus cladding) which provides superior air tightness to meet ‘chill store’ and ambient product requirements. The move paid off, with HelloFresh agreeing to take the building as its second UK production facility in August 2020.

Several other schemes are proposed with this technology, and one that is currently progressing speculatively is Mountpark’s MountPark360, Bristol. There are of course additional construction costs associated with incorporating this technology into the base build, but not to the extent that the landlord will necessarily demand a premium in the rental levels.

Pictured: Mountpark’s scheme in Bristol includes CA Twin-Therm® Chronus cladding.

Win-win for occupiers and investors

The fact that technologies such as the above can now be incorporated speculatively into the design of ‘regular’ and ambient warehouses at limited extra cost is a key break-through for the cold chain operators and property investors.

With sustainability now high on the agenda, any building that can be future-proofed to cater for the chilled market without the need (and cost / embodied energy) to retrofit with additional fit-out is a hugely positive step for occupiers. Given the high power consumption associated with these uses, developers may choose to go further still in future, adding PV to the roofs, for example.

This is an exciting period of growth and change in cold chain market. Investors that can adjust their thinking to accommodate this growth in demand will be well placed to outperform.

Download a copy of our Industrial & Logistics Market Report 2021.

Get in touch

James Polson

Executive Director - National Head of Industrial and Logistics

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email