While the boom in UK logistics is one of the economy’s clear bright spots, conditions in the supply chain are presenting real challenges for the construction industry. In this article, we explore these pressures and reveal how the industry has had to adapt.

Alongside supply chain issues, the huge amount of capital flowing into the sector is testing the capacity of the construction industry to deliver the new supply that investors and occupiers crave. The challenges have necessitated change from traditional approaches, which is likely to remain the case for the foreseeable future.

BUILD COSTS RAMP UP

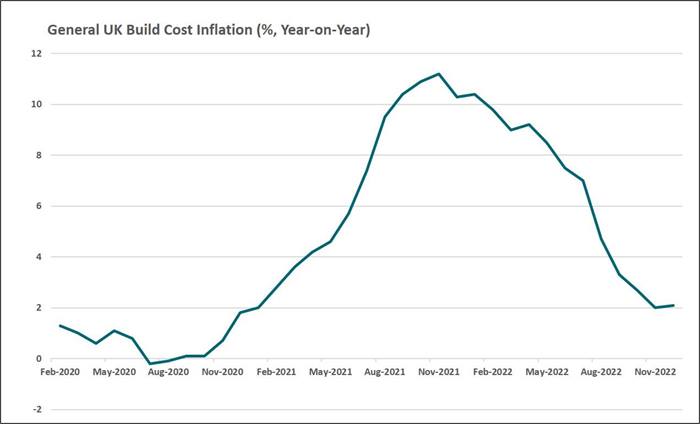

Well-documented difficulties in sourcing building materials and the general disruption in global supply chains in the wake the pandemic have driven up construction costs. The UK’s industrial and distribution sector has certainly not been immune from this.

According to the BCIS, general build costs in the UK have increased by 13% since the pandemic struck in 2020, peaking at an annual rate of 11% in November 2021. However, this appears very conservative when compared with warehousing, where project specific evidence points to build cost increases in the order of 32% since mid-2020.

The sharp rise in costs reflects issues with a number of key inputs to the warehousing build process. With regard to materials, the cost of steel has been a leading factor of inflation, with prices rising by over 70% since mid-2020. Moving forward, other material costs may become increasingly significant, with rises in concrete and glazing expected to come in the wake of high energy costs.

SUSTAINABILITY PREMIUM

Momentum towards more sustainable business practices and commitments to net zero carbon have undoubtedly moved up a gear over the past 12 months. As well as designing in more sustainable design features to lower the operational use of carbon, warehouse building contractors are also employing different methods of construction to reduce embodied carbon where possible. However, given the limitations that contractors can realistically go to, the purchasing of carbon credits is often utilised to help offset the carbon impact of development. But, if taken further down the supply chain, contractors like Winvic are reviewing construction techniques and methodologies of component materials to reduce the effect of embodied carbon prior to offsetting. This market has also experienced volatility in recent times, with carbon credits rising from £12 per tonne to £30 per tonne in the space of 12 months. At this price, this could add another £1.50 per sq ft on top of current construction costs.

LONGER LEAD TIMES

Despite the difficulties posed by rising costs, the lengthening of lead times to source the various input materials and the required labour is arguably far more challenging, particularly given the recent clamour to create new product among investors and occupiers. Of all the input materials associated with warehousing, cladding has proven to be the most challenging to secure in good time. Pre-pandemic, cladding requirements could be put to tender and on site within a period of several weeks. This has been turned on its head over the past 12 months, with lead times on this crucial building element extending to as long as nine months.

DELAYS IN THE PLANNING SYSTEM

Added to the above construction-related challenges, delays are increasingly being seen in the planning system, typically 3-6 months beyond expected determination date. The pandemic has impacted on the capacity of local authority planning departments around the country, a situation exacerbated by the increasing case load arising from the sky-high appetite for development in the sector. While this is not directly related to construction, delays in decisions add another layer of risk to a construction project, including potentially the need to retender.

JLR Mercia Park

PLANNING AHEAD

While the above might paint a dispiriting picture, key stakeholders are continuing to deliver in spite of the various challenges. The evidence is clear to see on the ground, where, despite the issues, a record 20.7m sq ft of speculative development in units over 50,000 sq ft is under construction across the UK, a rise of 80% year-on-year. So how is the industry adapting to manage and mitigate these pressures? In essence, traditional approaches have had to be put aside and every effort is now made to plan as far ahead as possible and minimise risk. Here we outline some of these approaches.

Order in early - Forward planning of the build process is now crucial to ensure delivery is secured in the required time-frame. Hence, the conventional order of processes has been reshuffled. Nowadays, orders of key materials such as cladding are put in at a very early stage, including prior to the granting of full planning permission or highways infrastructure works, to ensure the materials and resources are secured for the construction process.

Fix the costs - while a range key building materials cannot have their prices fixed, such as aggregates and concrete, others can, most notably cladding. Nowadays, rather than go to tender, contractors will more typically place a direct order with the supplier and agree to fix the price for a period of time, however typically only three months, with a fixed price allowance being agreed to service price increases beyond this.

Sharing the risk - increasingly, contractors are securing an indemnity agreement from the commissioning party, whether that be the occupier in a major design and build or the developer in the case of speculative development. Such agreements can run into millions of pounds, and can help to give a project certainty by taking the downside risks of cost escalation and delays away from solely the contractor.

Exploit the upsides - One rather blunt approach to better mitigate against high build costs has been for developers to convince prospective tenants to agree to a Day 1 rent review. In today’s fast moving market, this is increasingly being sought by developers of pre-lets to maximise the rental income at the point of occupation, in the process helping to offset some of the risks posed by rising construction costs. Notably, given the strength of demand and a sense of urgency to secure space, many occupiers are prepared to agree to such terms.

Danny Nelson, Head of Industrial at Winvic Construction Ltd said:

"At Winvic, we have worked through the current challenges with our developer and occupier clients and adapted well to these pressures. Our long list of active projects is testament to this; we are presently delivering 35 industrial projects across the UK, amounting to over 12m sq ft, with a continued pipeline to come forward over the course of the year".

"The perfect storm of insatiable demand and rising build costs has brought about clear change in the procurement and construction process associated with the delivery of projects within this sector, which in the short-term has no signs of changing. Notwithstanding further economic or political impacts, I am confident we can continue to support our clients and their needs by planning ahead, sharing the risks and collaborating closely".

Get in touch

James Polson

Executive Director - National Head of Industrial and Logistics

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email