Our Regional Office Market Report 2021 has found that a resurgence of demand for high quality workspace has driven a sharp recovery in take-up across the regional office markets, subsequently pushing prime rents to new highs.

The pandemic may be far from over, but the unwinding of restrictions and successful vaccination roll-out has brought normality back to office life and, crucially, occupiers back to the regional office markets.

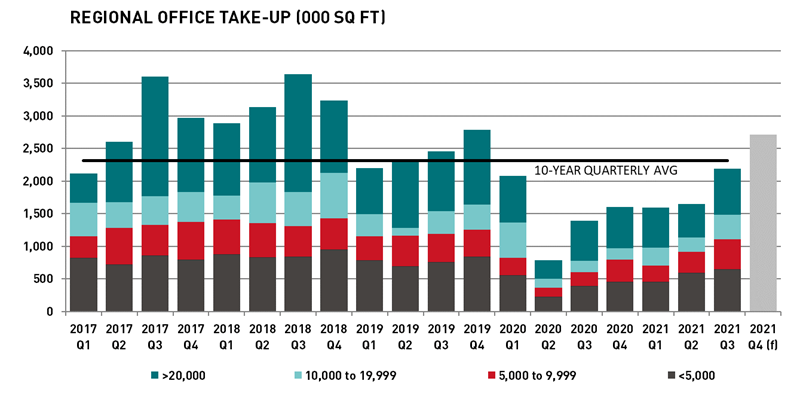

The recovery is rapidly gathering pace. At 2.2m sq ft, Q3 take-up across 20 key UK regional markets combined was the strongest quarterly outturn since the onset of the pandemic, while Q4 take-up is forecast to hit an impressive 2.7m sq ft, 17% above trend. Consequently, take-up in 2021 as a whole is expected to be circa 8.1m sq ft in 2021, rebounding by 42% on 2020 and only 12% below the annual average.

Newcastle is 2021’s star performer, with take-up in the city centre hitting a record high on the back of HMRC’s major 463,000 sq ft pre-let at Pilgrim’s Quarter in Q4. This is the second largest regional office deal on record and will be the largest of HMRC’s 13 regional centres when it becomes operational in 2027. Elsewhere, the Yorkshire cities of Leeds and Sheffield are expected to see 2021 take-up at 21% and 11% ahead of their 10-year averages respectively. In Scotland, Edinburgh city centre is also on track to see take-up at 4% above average.

As businesses try to attract staff back to the office, the recovery of demand has been characterised by a clear emphasis on quality. In Birmingham and Manchester city centres, grade A space has accounted for a staggering 72% and 69% of overall activity respectively during 2021 to Q3.

Meanwhile, overall supply across the 20 surveyed markets has picked up in the wake of the pandemic, rising by 10% since the beginning of the year to Q3. Placed into context, however, this stands 32% below its cycle peak in 2012, while the rise is far less pronounced in comparison with Central London, thanks to limited levels of grey space returning to the market in the wake of the pandemic.

Occupiers’ focus on quality has kept a lid on grade A supply, which accounts for space only 30% of the total across the 20 markets. Moreover, limited development starts point to renewed pressure on supply over the next two years. While spec development is occurring in 16 of the 20 markets, it is often limited to a single scheme, with the total volume of speculative construction underway falling by 27% during 2021 to 3.1m sq ft.

Surprisingly, the impact of the pandemic has done little if anything to affect prime headline rents across the regional markets and many have actually witnessed growth. Nine of the 20 key markets saw prime headline rents tick-up during 2021, with six of the 20 markets tipped to see prime headline rental growth in excess of 10% on current levels by the end of 2023, including Birmingham city centre (+15%), Leeds (+12%) and Newcastle (+11%).

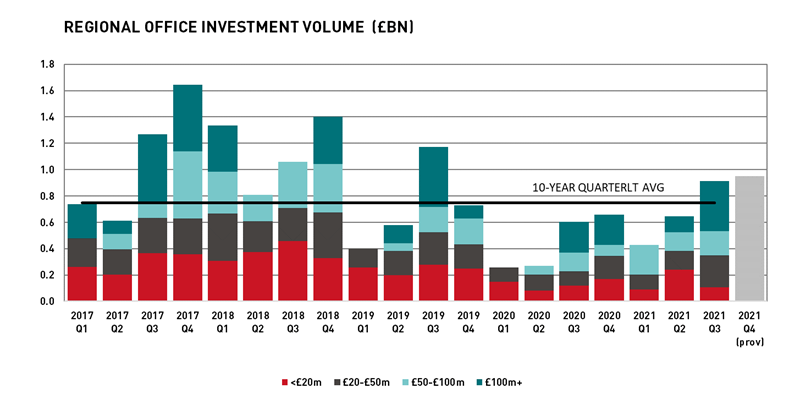

Meanwhile, the investment market has also been improving, underscoring the faith investors have towards regional offices. £913m of regional office assets changed hands in Q3, the first time volume has run ahead of the quarterly average since Q3 2019. Q4 is also on course to deliver the strongest quarter of volume in 2021.

Major transactions have been key to the recent uptick in volume. In November, LandSec acquired a 75% stake in MediaCity, Salford for £425m, while in August, Regional REIT purchased a portfolio of regional assets from Squarestone for £236m (NIY 7.80%). Back in July, Longmead Capital finally purchased 3 & 4 Piccadilly Place, Manchester from ARES Management for £143m (NIY 6.45%), a deal long delayed by the pandemic.

With a thinning development pipeline, many occupiers are likely to find themselves increasingly frustrated with available options. A growing tendency among occupiers to exchange quantity for quality is set to drive accelerated polarisation between prime and secondary product, leading to a repricing of secondary assets which could unleash a wave of opportunity for landlords and investors over the coming years.

Ryan Dean, Head of Office Advisory, LSH said:

“Occupier confidence is recovering well despite the challenges the market still faces. While many occupiers are looking to consolidate their office footprint, they are placing increasing focus on quality, including staff amenities, wellness, ESG and carbon reduction commitments.

Arguably, as evermore employers seek to make the grade on their workspace ambitions, perhaps the only limit to take-up in 2022 is the level of choice available to them. Limited development points to looming pinch-points in supply, but this will translate into opportunities for landlords and investors to make the grade, by repositioning existing buildings and adding value”.

Charlie Lake, Director, Capital Markets, LSH added:

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email