While 2020 will always be remembered for the disruption caused by a global pandemic, the relaxation of the UK planning system has also been turbo-charged this year. These changes, while certainly not immune from criticism, provide investors and developers with considerable opportunity to reposition assets and create value.

A number of changes to the planning system have been enacted which have the power to accelerate transition in the UK built environment. These comprise new Permitted Development Rights and proposed reform to the (1987) Use Classes Order, the latter of which is under review at the time of writing. In essence, these liberalising reforms aim to boost housing supply and enable flexibility between commercial uses in order to revive ailing town centres.

Demolition Job

On 30 June 2020, Prime Minister Boris Johnson announced the expansion of Permitted Development Rights (PDR), which allows developers to demolish vacant office and industrial buildings and replace with residential, without planning permission.

If a development is to make use of the new right, the old building must:

- Have a footprint no larger than 1000 m sq and be no higher than 18m;

- Have been built before 1990;

- Not to be listed or within a conservation area, national park etc.

- Have been vacant for at least 6 months before the date of the application for prior approval.

The new right represents a major ramping up of the previous position, as it allows buildings to be demolished rather than merely being converted. The move also attempts to address growing criticism, as detailed in The Levitt Bernstein Report (2019), that the existing right was giving rise to sub-standard dwellings, often lacking in space, natural light and ventilation.

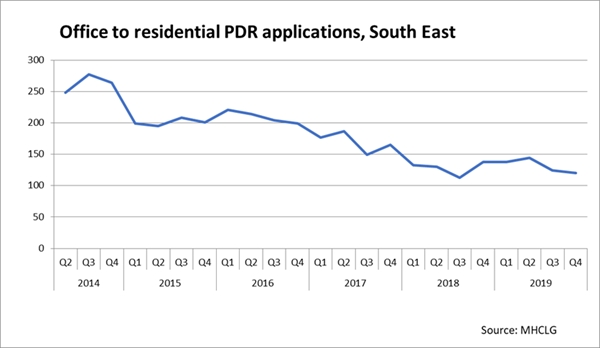

Another justification for the Government’s move is the growing sense that much of the ‘low hanging fruit’ for office to residential conversions has already been picked – in essence obsolete offices in good residential locations that can be easily converted. This is certainly reflected in the South East, where the rate of take-up under the existing PDR has slowed from its peak in 2014.

A second wave of PDR?

While the new PDR is still very much in its infancy, it arguably has the potential to drive a second wave of use demand akin to 2014 levels. Evidence suggests this right could enable an important source of new housing supply over the coming years. According to government statistics, 54000 new dwellings were delivered through the existing office to residential PDR between April 2015 to March 2019; 6.2% of the total net housing output in the period.

Firstly, the immediate economic challenges posed by the COVID-19 pandemic have placed considerable strain on the performance of the commercial property market. The contraction and possible failure of businesses in the wake of the virus would be expected to lead to an increase in vacancy levels, in the process putting more office stock in line for change of use considerations.

Secondly, the enforced remote working experience during much of 2020 is likely to accelerate the transition towards more flexible forms of working. A key side-effect of greater home-working in the future is that occupiers will exchange quantity for quality in their space demands. As above, reducing space demands will lead to increased vacancy, lower values and therefore greater propensity to seek change of use.

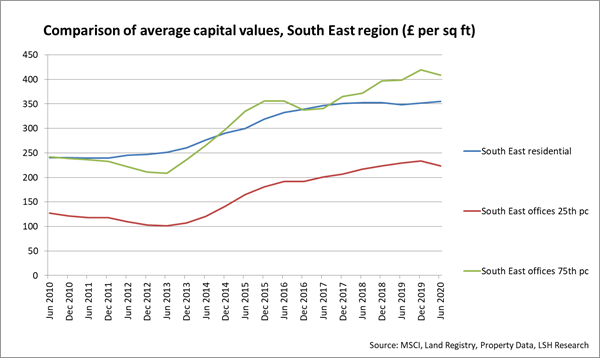

Finally, complementing the push factors above are the pull factors of the residential market. The entrenched undersupply of housing in the UK is well-documented, and partly explains why residential values have moved ahead of commercial / office values in many parts of the UK over the past decade.

Moreover, a specific pull factor associated with the new PD rights is that, just like their predecessor, there is presently no requirement for an affordable housing contribution via a Section 106 agreement. As a result, seeking change of use via this route can support developer profit margins and boost scheme viability relative to standard residential development where planning permission is required.

Rethinking Office Assets

Across the UK landlords and investors will be increasingly minded to consider the long-term future of their office assets. This is certainly true of poorer quality secondary offices, where growth in prices have underperformed their prime counterparts over past few years, and which are now arguably exposed to accelerated structural change in occupier demand in the wake of COVID-19.

In the past, the gradual obsolescence of office assets would drive the rationale to deploy refurbishment capex to restore the quality of the asset and drive rents. Now, via PDR, investors also have the opportunity to replace the asset completely with residential without the financial burden of Section 106 obligations.

Sizing up the opportunity

The scale of opportunity is, potentially, huge. According to somewhat dated official statistics from the Valuation Office Agency (VOA), as at 2004, circa 74% of total office stock in England and Wales was built prior to 1990. Applying typical redevelopment rates to account for the years since then suggests at least 50% of current stock predates 1990. Of this, most would be eligible for change of use according to sizing, as only a small proportion of current built stock will have a footprint of over 1,000 sq m.

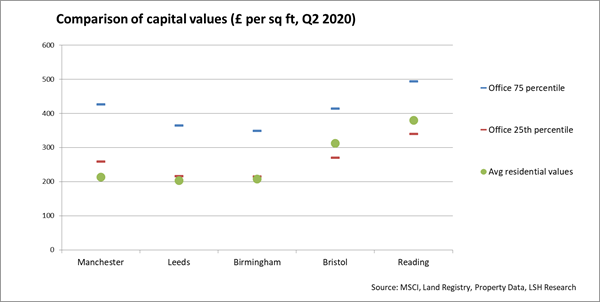

Ultimately, market fortunes will influence the uptake of this new PDR between locations. As it stands, the current average pricing premium of offices over residential is much stronger in the north of England (see chart below), implying that values need to converge more closely before appetite for PD will match that seen in the south. However, if secondary office values erode over the coming years and residential values prove resilient, more and more locations may come into play.

Bristol, where average residential values are within the range of office values, is a case in point. Since April 2015, the city has seen approximately 1.1m sq ft of office space converted to circa 1,300 residential units under the existing PDR (accounting for 18.9% of its total net additions), reflecting the fact that new-build residential values in the city centre are more than a match for good quality office space.

In response to the previous PDR, many local authorities obtained Article 4 directions to withdraw PDR to prevent a perceived economically damaging loss of office space in their respective business districts. As this is a new right, local authorities will in turn have to obtain a new Article 4 direction to prevent further loss of stock.

From past experience, this move can take up to 12 months to gain central / local government approval and put into effect, implying that vacant or soon to be vacated office space offers an opportunity for change of use regardless of location.

Tip of the iceberg?

Far reaching as the new PDR could prove to be, the reform to the 1987 Use Classes Order (UCO) may prove an even stronger catalyst for change of use to residential. As it stands, the proposed reform only allows for change of use between key commercial sectors (collectively to be referred to as Use Class E) with no mechanism as yet to allow change of use to residential from this new, broader use class.

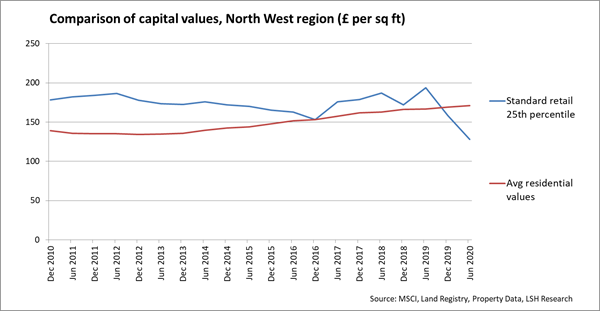

Arguably, given structural change and the sharp drop in values, retail may offer far greater potential for change of use to residential over the years ahead than offices. If policy is liberalised to allow this, for example through PDR from the new Class E to residential, it has the potential to provide a considerable boost to brownfield housing development and restore the vitality of UK urban centres.

In parts of the UK, particularly in the North, office values continue to command a significant premium over residential values, in the process making a weak case for pursuing change of use. The position changes when considered against retail. In the North West, for example, while average residential values currently sit 18% below the weakest quartile of office values, they have recently moved higher than the weakest quartile of retail values.

Exciting as these opportunities may be, any such changes must be accompanied by clear guidance and key checks and balances to ensure that change is managed in a way that protects and enhances an urban centre’s remaining commercial offer.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email