COVID-19 and the lockdown inevitably weighed heavily on the Belfast office market in H1 2020, mirroring the pattern across the UK.

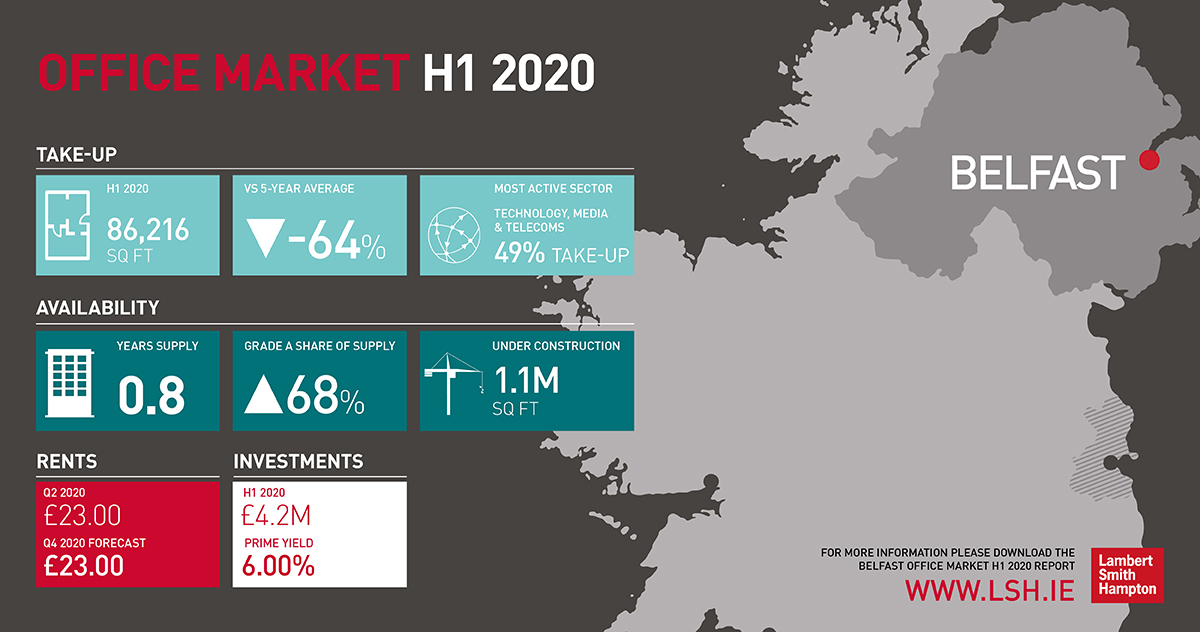

H1 take-up was the lowest on record, standing at 86,216 sq ft, 53% below the same period last year and 64% below the five-year H1 average, according to our latest Belfast Office Market Report H1 2020.

The technology, media and telecoms sector were responsible for the largest H1 deals, namely Applied Systems at Adelaide Exchange (19,160 sq ft) and Imperva at Arnott House (17,397 sq ft). While grade A space accounted for 60% of take-up, there was an absence of large and medium sized deals, with the majority of deals being less than 5,000 sq ft.

Despite weak take-up, supply continues to ebb, falling by a further 8% in H1. Comprehensive refurbishments make up a significant proportion of grade A availability, including The Vantage (65,000 sq ft), The Kelvin (37,796 sq ft) and East Tower, Lanyon Plaza (35,100 sq ft). All of these buildings were due for completion in the next nine months, but may be delayed due to COVID-19.

In recent years refurbished offices have filled the void of speculative development, but that trend has reversed more recently with the return of new build development. There is over 1.1m sq ft of office space currently under development/refurbishment, of which 920,322 sq ft is new build.

Most notably during the first half of 2020, two speculative schemes got underway. Wirefox’s Paper Exchange on Chichester Street commenced in February 2020 (155,133 sq ft) and the joint venture between Titanic Quarter Ltd and Belfast Harbour of Olympic House (150,000 sq ft) commenced in June 2020.

Greg Henry, director of agency, said:

“The first half of 2020 has been unprecedented, COVID-19 has caused significant economic shocks and the full consequences on the employment market are yet to be felt as the government’s furlough scheme is only just starting to be wound down. The sudden necessity to shift office employees from the office environment to working from home and its general success has the potential to create significant long-term change in the office occupier market.

“With government advice changing offices are gradually re-opening, occupiers are likely to be more amenable to flexible working practices and may be re-assessing the quantity or type of office space they really require.

“As one of the tightest supplied markets in the UK, Belfast is relatively well-placed to deal with the impact of COVID-19. Demand from occupiers remains, but with many delaying returning to their current premises until at least September momentum on new deals is slow. While it is expected that take-up in the second half of the year will remain subdued, the key city fundamentals of lower employer and occupancy costs, lower cost of living and highly skilled people, along with the forthcoming new developments, will continue to attract potential occupiers.”

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email