The very best office space is performing well, evidenced by rapid absorption and an ability to command a step change in market rents. With the supply of prime space limited, there is considerable scope to deliver more, but which markets offer the most opportunity?

Download the Thames Valley and South East report in full here

Prime Defined

In a bid to attract staff to the office and demonstrate commitments to ESG, recent years have driven a focus of occupier demand and hence development interest towards very high quality office space, considered ‘prime’. These buildings have provided a key stimulus to market activity, playing a major role in driving above trend take-up across a number of South East markets over the past year. But what is meant by prime? While there is no industry-accepted definition, prime buildings need to convey a number attributes that set them apart from the competition. In addition to meeting the conventional grade A specification, prime buildings must demonstrate strong ESG credentials (including an EPC A/B rating) and, in our view, possess at least two high-quality on-site amenities, examples including ‘healthclub’ standard changing facilities, outside space (typically a roof terrace), on-site café, gym and flexible workspace.

Prime Supply is Unevenly Distributed

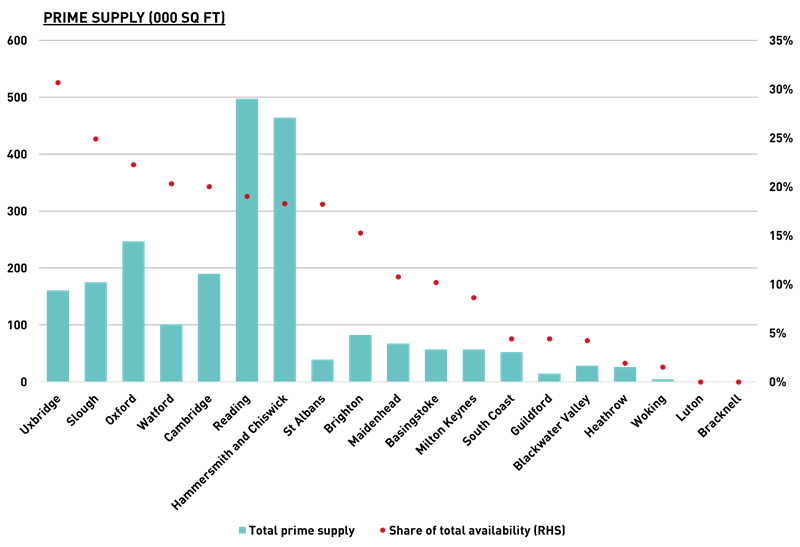

Total office supply across the South East has driven upwards over recent years, but the vast majority is either secondary or, frankly, unremarkable grade A space. Meanwhile, prime-defined office space is limited, reflecting its relatively recent emergence and aggressive rates of take-up upon scheme delivery. While total supply across all the South East markets has climbed to a 12-year high, the amount deemed prime accounts for only 11% of the overall total.

Moreover, 63% of total prime supply in the region is concentrated in just five of the key markets, namely Hammersmith & Chiswick (including White City), Reading, Slough, Oxford and Cambridge. Hammersmith is a major focus, with prime availability of 464,000 sq ft accounting for 23% of the region’s total prime supply alone. However, Uxbridge stands out as the most well-supplied with prime space in relation to current availability, equating to c.30% of the total.

But the above are very much the exceptions. Nine of the South East’s 25 key markets are completely devoid of any options that qualify as prime within their respective supply profiles, including the likes of Basingstoke, Luton and Bracknell. In many cases, prime supply is limited to at best a couple of options, some of which are partially let, with prime supply accounting for less than 10% of total availability in Milton Keynes, the South Coast, Guildford and Woking.

Prime-Fuelled Growth

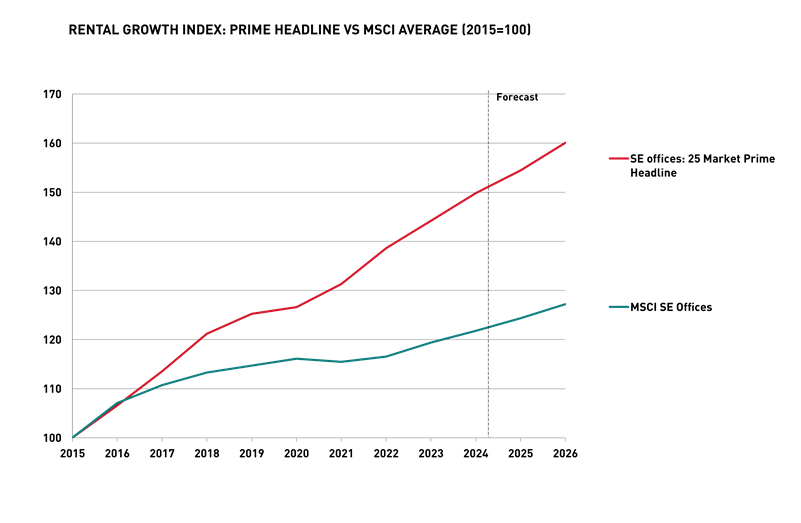

The delivery of prime buildings has driven a step change in headline rents compared with the pre-COVID benchmarks, with growth of circa 20% being typical over the past few years. Across the 25 South East markets, prime headline rents have risen by 6.9% over the year to Q1 2024, the strongest in six years and the second strongest annual rate of growth on record.

However, this benchmark is based on a narrow set of buildings. The strong rental growth exhibited by prime buildings reflects both their relative scarcity and also, more simply, the willingness of corporate occupiers to pay for the privilege of the best quality space. At a challenging time for the investment market, this growth has been key in supporting scheme viability. Crucially, strong rates of rental growth are forecast to continue over the next few years, reflecting strong competition for limited prime options in the market.

Prime buildings have also been seen to let up aggressively, often leaving more standard and long-since void grade A options trailing in their wake. Notable examples include Tempo, Maidenhead, Clarendon Works, Watford and One Station Hill, Reading. Of these three schemes, the first two were respectively fully let and close to fully let prior to completion, while One Station Hill, Reading already has circa 120,000 under offer to a range of occupiers.

Huge Opportunity?

While financial market conditions have proven very challenging for the investment market, the strength of occupier demand and the high rents seen for prime buildings provides a compelling case for development, especially so given the limited supply of existing prime options in most of the South East’s key markets. With the exception of Cambridge, the pipeline of anticipated speculative development is currently extremely thin across the region. The opportunity is huge, but where is the demand coming from and which markets reveal the most potential?

Delving into Demand

Logic dictates that the best-placed markets for development opportunity are those that lack prime options relative to demand. LSH has undertaken a detailed analysis of the South East markets to reveal hotspots of ‘structural demand’ in the market (i.e. the quantum of lease breaks and expiries over 5,000 sq ft between Q1 2024 and end 2028) in relation to prevailing levels of grade A supply. Maidenhead has the highest quantum of lease events of any market relative to stock, with 945,000 sq ft of breaks and expiries up to 2028 accounting for 27% of the total. Reading and Slough follow close behind, where lease events equate to over 25% of stock. In contrast, Luton has one of the lowest quantities of total lease events, equating to only 10% of total stock, the lowest proportion of all 25 markets covered.

Prime Opportunity

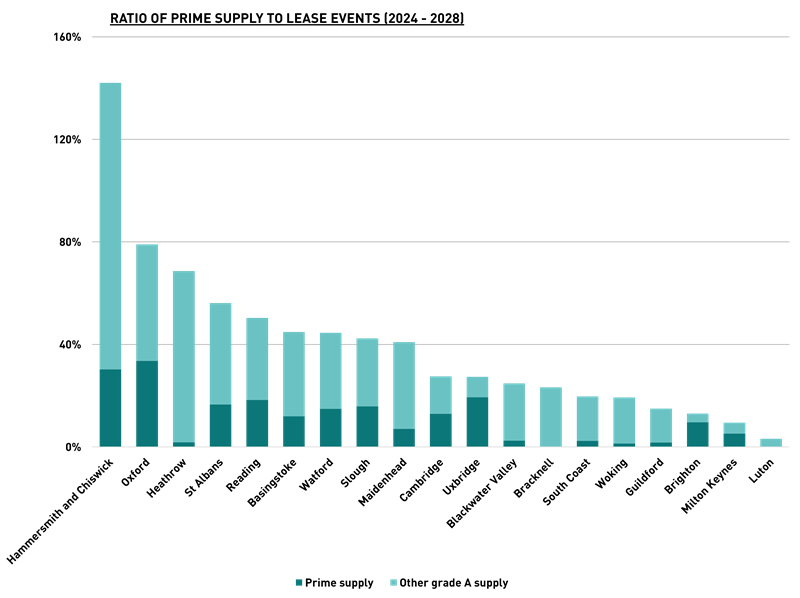

But how does this demand relate to current supply? Our assessment in the above chart reveals striking differences between locations across the South East.

Some of the markets have both a low amount of grade A space alongside extremely low (or even absent) prime supply relative to structural demand, examples including Blackwater Valley, South Coast, Woking, Guildford and Brighton. On this basis, these markets offer perhaps the strongest potential for the successful delivery of prime schemes.

Meanwhile, other locations, such as Basingstoke and Heathrow, show a relatively high level of grade A supply but a limited quantum of specifically prime supply relative to structural demand. Here, the risks are arguably higher, but the developer can take some comfort from evidence of much stronger rates of absorption being seen for prime space compared with conventional grade A offerings.

In contrast, markets such as Hammersmith & Chiswick, St Albans and Oxford appear relatively challenged, with a high proportion of grade A supply and, in addition, a good choice of prime options relative to structural demand. In these markets, development potential may depend more on assumptions on growth in the occupier base and/or the potential to attract in-movers from other locations. Oxford provides a clear example, whereby strong growth and expansion in life sciences are likely to compensate for an apparent lack of lease events relative to supply.

First Mover Advantage

Developers across the office market are beginning to recognise considerable opportunity to successfully deliver the space that occupiers are increasingly demanding. While many investors are constrained by relatively high debt costs, the rapid absorption of prime space being seen across many locations is a clear window of opportunity for other buyers to enter the fray.

Download the Thames Valley and South East report in full here

Clarendon Works, Watford

- Developed by Regal London

- Amenities include a gym, business lounge, Café, 96 bike storage spaces and 150 parking spaces

- Targeting BREEAM Excellent rating, EPC A, and WELL Platinum

- Transactions from Epson and YoooServ, and Allwyn

One Station Hill, Reading

- Developed as a joint venture between Lincoln Property Company and MGT Investment Management

- Amenities include a gym, wellness facilities, rooftop terrace, 204 bike storage spaces and 31 showers

- Targeting BREEAM Excellent, EPC A and WELL Platinum

- 115,000 sq ft of the 275,000 sq ft total currently under offer

Tempo Maidenhead

- Developed by Legal & General Investment Management (LGIM) Real Assets

- Amenities include creative and outdoor areas, internal atriums, three rooftop pavilions and a ground floor café

- Targeting BREEAM Excellent and EPC A

- Transactions from Johnson & Johnson and Black & Decker

400 Longwater Green Park, Reading

- Developed by Mapletree Investments Pte Ltd

- Amenities include outdoor gym equipment, landscaped terraces, 13 showers, 268 bike storage spaces and 361 car parking spaces

- BREEAM Excellent, EPC A, and WELL Platinum

- The whole building transacted to Wood Group in Q4 2023

Download the Thames Valley and South East report in full here

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email