Hybrid working is here to stay. While this has advantages for both employees and employers, a key challenge for occupiers is how to maximise the utilisation of office space across the working week.

Download the Regional Office Market Report 2022 here

OFFICE ATTENDANCE IMPROVES

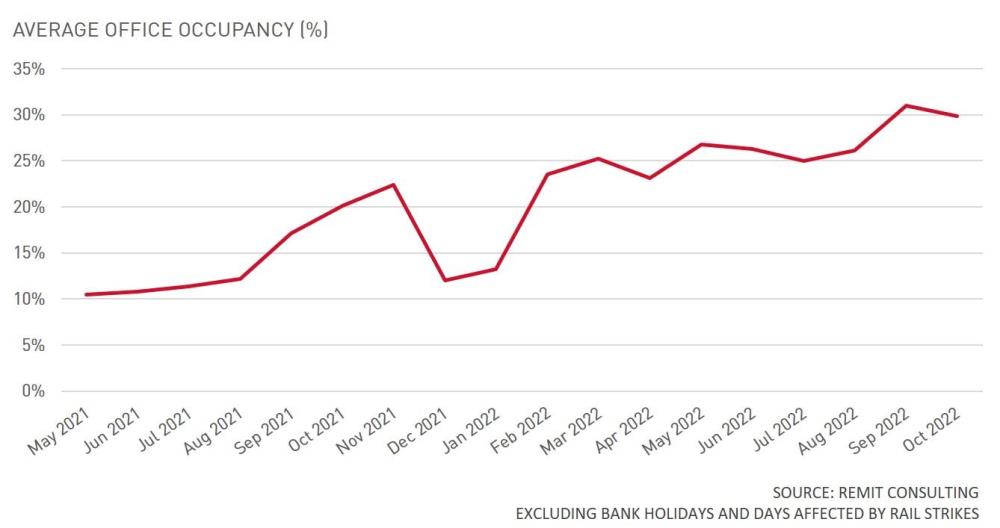

Data from Remit Consulting shows that there has been a gradual increase in office attendance since the easing of COVID restrictions in early 2022. In October, daily office occupancy averaged close to 30% nationally, after levels nearer to 25% had been the norm earlier in the year.

There was a noticeable uptick in office attendance after the end of the summer holidays, albeit it was not quite the widespread return to the office that some businesses had wanted. Improvements in occupancy rates appeared to stall in late October and November, remaining stubbornly well below the 60-80% that had been typical prior to the pandemic.

The Remit data highlights considerable intra-week variations in office attendance. In October, occupancy rates averaged 36% between Tuesday and Thursday (excluding days impacted by rail strikes). However, the days at either end of the week continued to see much lower attendance, with Monday averaging 26% and Friday at 19%. The latter has consistently been a laggard, with attendance on Fridays increasing at a slower rate than all other days of the week.

REGIONAL VARIATIONS

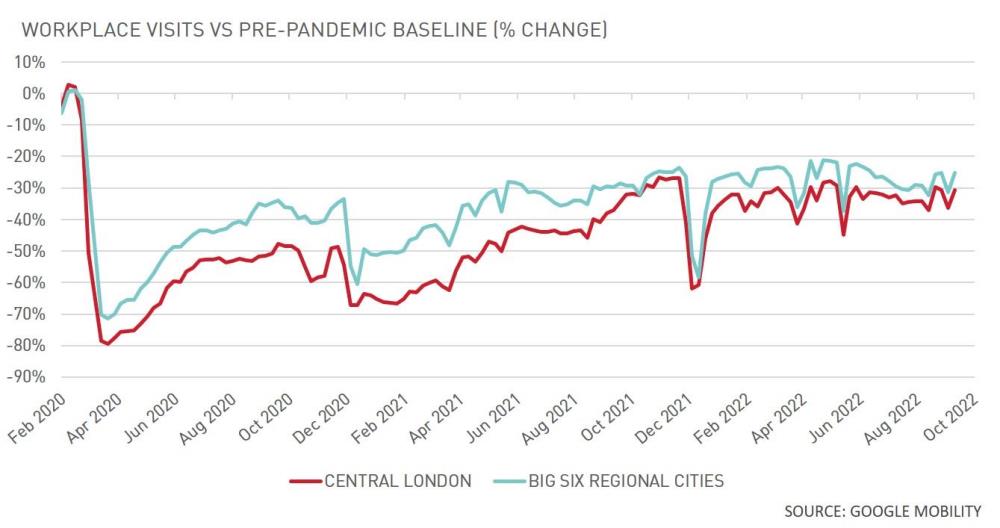

Alternative data from Google indicates that workplace attendance has been less severely affected by the pandemic in the UK’s major regional cities compared with Central London. The Google data is not purely focused on offices, but it shows that workplace visits across the UK in October were around 20% lower than the pre-pandemic baseline. Major regional cities were a little below this, but workplace visits in Central London were still more than 30% down.

While there has been a narrowing of the difference between Central London and the regional cities this year, the shorter average commutes that workers have outside the capital appear to support higher levels of workplace attendance. However, the Google data shows only modest signs of improvement across the UK in recent months and, like Remit’s office data, it suggests that the pandemic has engendered a permanent shift.

BEATING THE MONDAY (AND FRIDAY) BLUES

Lower overall office attendance levels are not necessarily a bad thing for employers, partly because companies may be able to reduce occupational costs by downsizing office space. There is also a significant body of evidence to suggest that some homeworking may boost employee output. Studies conducted by Stanford University in the US during the pandemic found that around 60% of employees reported being more productive when working from home, and that post-pandemic working arrangements could provide a 5% productivity boost to the economy.

A bigger issue for employers could be the wide variations in office attendance across the week, with the much lower office occupancy on Monday and Friday potentially leaving companies with valuable office space that is only used at anywhere close its capacity on three days a week. At a time when heating and lighting space is increasingly costly, occupiers may feel that is a waste of an expensive asset. Generating value from office space on low attendance days, and encouraging workers into the office on these less popular days, could be key challenges for employers.

For some occupiers, a complete rethink of how office space is managed over the course of the week may be needed. This could mean closing or part-closing offices on quieter days, using serviced offices to supplement core offices on busier days, or even hiring out excess space to other organisations on low-use days.

Landlords may ultimately need to develop new flexible leasing models that reflect tenants’ fluctuating space needs across the week. Serviced offices are particularly well placed to cater to occupiers that do not need full-time space, and an emerging trend within this sector is for offices to be ‘timeshared’ by two or more businesses that use them on different days of the week.

GETTING BACK

Major employers are taking widely different approaches to the return to the office. Some companies, such as Deloitte, have fully embraced flexible working, allowing UK staff to work from home whenever they want. In contrast, loud opponents of home working have included Elon Musk, who has demanded that Tesla and Twitter employees be in the office for at least 40 hours a week.

Most companies are navigating a middle ground where hybrid working has been adopted, but an increased level of office attendance is encouraged. An LSH survey conducted earlier this year found that nearly half of organisations felt that action needed to be taken to boost office attendance.

Considerable care needs to be taken over how this is achieved, as a growing number of high-profile global businesses are reported to have faced significant resistance when attempting to mandate fuller returns to the office. Recently, for example, a group of staff at Apple launched a petition in response to a memo from CEO Tim Cook saying that staff would have to come into the office for at least three days a week.

With employees now used to hybrid working and with a tight labour market making it easier for them to move to competitors offering more flexible working arrangements, a prescriptive approach to office attendance runs the risk of antagonising employees and making it harder to recruit and retain staff. This is unlikely to change unless a recession causes a dramatic shift in the labour market and turns it into an employer's market.

INCENTIVES AND ATTRACTIONS

Firms wishing to boost office attendance thus need to provide positive incentives that motivate workers to spend time in the office. The most direct approach could be financial incentives, with firms needing to recognise that travel to the office costs employees time and money, which they may be particularly reluctant to spend in the middle of a cost-of-living crisis. The expense and inconvenience of commuting, rather than the nature of office work itself, is often the biggest obstacle to office attendance. The idea of paying staff allowances to cover commuting costs, while not yet widespread, has gathered some momentum, with Bloomberg being an example of a major firm that has explored this approach.

More commonly, firms have attempted to encourage staff back to the office by offering incentives such as free breakfasts and lunches, complimentary gym passes and childcare facilities. These can help to both offset some of the costs associated with office attendance and support employee wellbeing. There is also the potential for enhanced versions of some incentives to be offered on Mondays and Fridays, to help draw people into the office on these quieter days.

Attractive and stimulating working environments may also be key to boosting office attendance. Research recently published by Brookfield found that staff are considerably more likely to prefer office work to home working when they have access to office spaces that are enriched by art, culture and wellness facilities, rather than more basic ‘lean offices’. This is supporting the continued flight to quality currently being seen in office occupier markets.

Brookfield’s research suggests that the social aspect of the office can be a key attraction, particularly for younger workers. Offices support face-to-face social and work interactions that simply aren’t possible in the home. To take advantage of this, occupiers could look to reconfigure offices to provide a greater variety of collaborative working spaces, or to arrange regular social or team building events. Scheduling such events for Mondays or Fridays is one way of ensuring that offices are in use on these days.

RETHINKING OFFICES

Nearly all office occupiers will need to embrace hybrid working to some extent and adjust their office footprints to meet changed requirements. The unique feature of the post-pandemic period is that requirements are likely to vary across the week on a larger scale than has ever been seen before.

For occupiers in regional UK cities seeking to bring workers back to the office in greater numbers, commuting times may be a less significant obstacle than they are in London. To build on this advantage, firms will also need to provide attractive office environments that workers actively choose to come to in preference to the home.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email