The emphatic arrival of flex work space providers into the UK’s regional markets is no flash in the pan, reflecting profound structural changes in occupiers’ demands.

Amid this changing landscape, landlords who choose to embrace their tenants as customers stand to prosper most.

The WeWork distraction

WeWork’s recent travails have, perhaps unfairly, quelled some of the clamour surrounding the growth of the flex space market around the UK. True, if WeWork were to fail, it would have immediate repercussions for many landlords, particularly in Central London, where it is now the largest tenant after the UK government.

However, WeWork’s troubles are largely of their own making and do not reflect issues around underlying demand. Occupier demand for flexibility is only going to grow over the coming years, and landlords need to adapt or risk being left behind.

The internet revolution

The growth of the flex space market over recent years, be that managed, coworking or more conventional serviced office formats, has been much discussed but little theorised. So why is it happening now and what’s really changed?

Ultimately, technological advances have enabled the shift.. The internet revolution has substantially reduced the cost of undertaking business, in the process fostering the explosive growth of smaller, more specialised businesses and eroding the traditional benefits of scale.

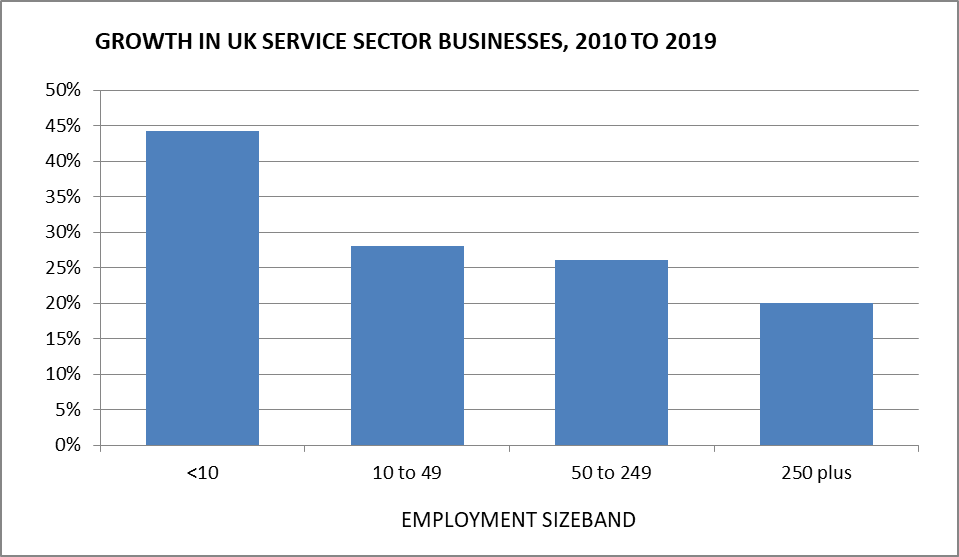

Since 2010, when the UK emerged beleaguered from the global financial crisis, the number of service sector businesses with a headcount of below ten employees has grown by a massive 44%, compared with growth of 19% in the number of businesses with more than 250 employees. As a result, the nature of demand is shifting – shorter leases, fitted space and collaborative environments are increasingly the order of the day.

Rippling into the regions

In response to this structural change, the number of flexible office providers active in the UK has expanded significantly while existing heavyweights have adapted their typical offer to compete, eg . Spaces, Regus’s coworking brand.

But one of the clearest trends over the past two years has been the wave of demand flowing from Central London into the UK’s regional office markets, as the main operators have raced in to grab market share. Across 40 key UK regional markets, take-up from flex space providers hit 1.25m sq ft in 2018, a nine-fold increase on 2016’s level, while a similar amount is expected again in 2019, with over 1m sq ft transacted in the year to Q3.

Putting growth into perspective

Understandably, the UK largest and most liquid regional markets have seen the bulk of activity. Since 2016, Birmingham and Manchester city centre have together accounted for 41% of all flex space take-up across the 40 regional centres.

Despite the big numbers in absolute terms, flex take-up as a proportion of stock arguably provides a better perspective. On this basis, Uxbridge has seen more serviced office take-up than any other market, although since 2016 it is only equivalent to a rather unspectacular 2.6% of existing stock levels. The only other markets where flex take-up is equivalent to more than 2% of stock are Birmingham (2.5%), Reading (2.4%) and Manchester (2.3%).

Untapped potential?

While several major cities have taken the lion’s share of flexible office operator demand to date, our analysis of the current market shows there is enormous untapped potential elsewhere in the UK.

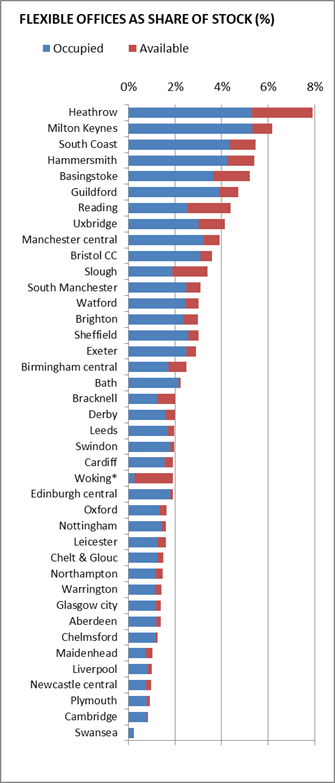

Firstly, compared with Central London the regional markets generally have a smaller supply of flexible offices as a share of stock. Of the 40 regional markets surveyed only Milton Keynes (6.2%) and Heathrow (7.8%) are ahead of Central London’s 5.9% and, on average flexible office space accounts for only 2.5% of current stock.

Some markets also look relatively untapped. Flexible offices account for below 2% of total stock in Liverpool, Edinburgh, Cardiff, Oxford and Cambridge to name a few, despite arguably boasting attractive credentials in terms of an expanding tech sector and or strong the growth of business start-ups.

The 64 million dollar question

When, and at what level, flexible office provision will reach its ‘natural’ level is the 64 million dollar question. As more and more occupiers, and indeed their staff, get a taste of these environments, it only seems logical that flexible offices will become the smaller occupier’s accommodation of choice, with a range of options to suit different budgets and tastes. In the most conducive markets, it is perfectly conceivable that flexible office operators will come to represent over 10% of stock levels by 2030.

LANDLORDS GO FLEX-ABLE

While it remains to be seen quite how much of the regional markets flexible operators will take in future, perhaps the largest impact of the rising demand for flexibility will be on landlord behaviour.

As an ever greater share of occupiers choose to behave more like customers than tenants, landlords may find themselves preferring to cut out the middle man of the serviced office provider and cater for more flexible requirements directly themselves or offer this service through a managed provider.

This phenomenon is in part driven in the larger markets by the need for landlords to fill space and compete at the smaller end of the market. There is also a growing realisation that while there may be a limited number of large requirements at any one time, there is constant churn of demand among smaller occupiers.

What the Flex market has done is show that there is continued demand in the regional office markets for office space as the majority of centres are filling quickly, albeit not on a conventional basis. The flex landlords are challenging the norm which in turn is making landlords evolve in a way that may provide adiditonal service income…watch this space.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email