While dealing with Covid 19 will cause pain across all sectors of the UK economy, it may well accelerate the structural changes driving demand in the logistics market.

Coronavirus infects economy

At the start of 2020, economic discussions centred on the possibility of a post-election bounce in the UK economy, while the direction of Brexit trade negotiations appeared to be the biggest risk to growth. How quickly things have changed. With astonishing speed, the Covid-19 coronavirus has become the most serious threat to emerge to the UK and global economy since the 2007-08 financial crisis.

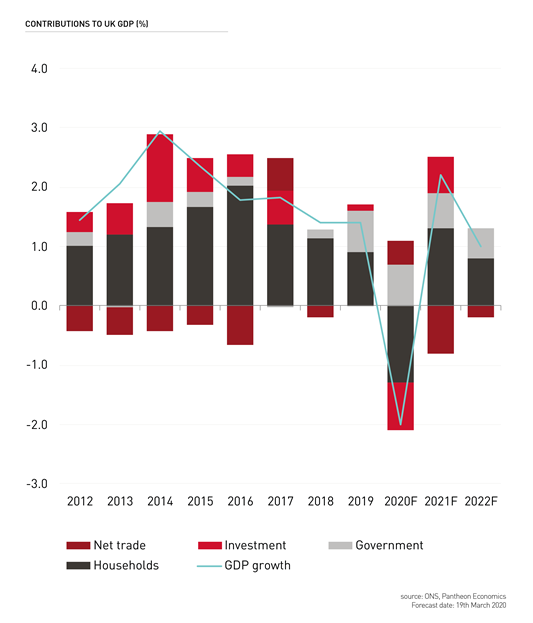

At the time of writing in March 2020, economic forecasters were still scrambling to assess the likely severity and length of Covid-19’s impact on GDP growth. Until it is brought under some measure of control, there will be enormous uncertainty around any economic predictions, but it is clear that the near-term impact will be huge. Many countries, including the UK, are at immediate risk of entering deep recessions.

Economic pain ahead

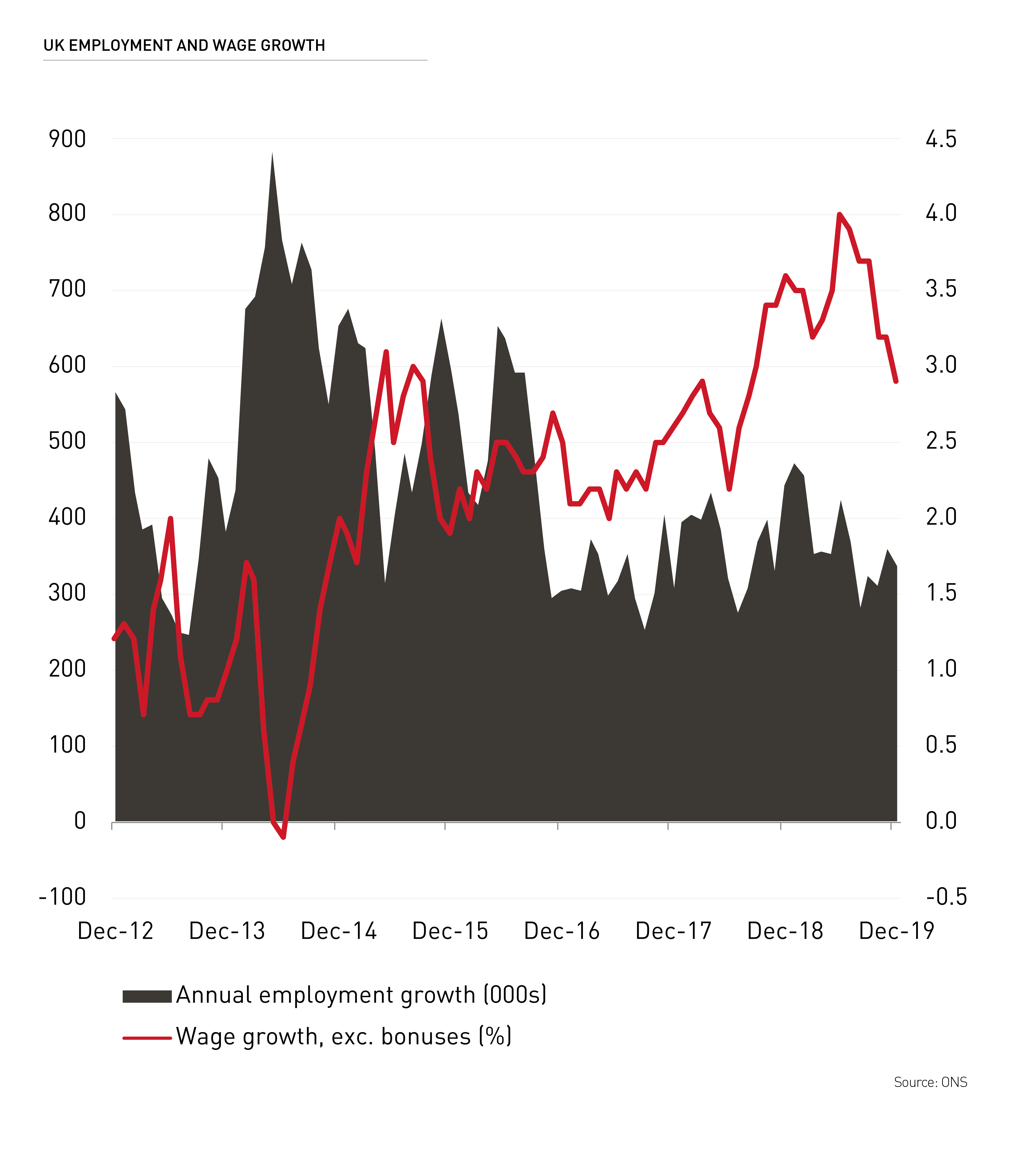

The expected bounce in the economy that sentiment surveys had pointed to in early Q1 2020 has been turned upside down by Covid-19’s impact on consumer behaviour and business activity. Restaurants, hotels and cinemas have been among the first to feel the effects of reduced demand as the public starts to follow government advice on social distancing.

However, the height of the recession is likely to come in Q2 2020, with the government’s scientific advisers expecting the virus to be at its peak in May to June. With parts of the economy effectively shutting down, the scale of Q2’s GDP contraction may be unprecedented. Many forecasters anticipate that it will be significantly worse than anything seen during the global financial crisis.

The shape of a subsequent recovery is dependent on the speed and effectiveness with which Covid-19 is contained. Optimists will be hoping for a a ‘V shaped’ recession; essentially a short, sharp shock in H1 followed by a strong recovery in the second half of the year. While Covid-19 could have profound impacts that are felt well into H2, an economic recovery of some kind is likely to have begun by 2021.

Logistics sector more immune than others?

The logistics sector will certainly not be immune to the impact of the coronavirus, but major occupiers within the sector may be less severely affected than the hardest-hit parts of the economy such as hotels and restaurants. Manufacturers and distributors of items such as food and drink, consumer goods and healthcare products may see that demand holds up, or even increases, during the crisis period. However, demand for discretionary goods whose purchases can be deferred will be more greatly impacted.

Catalyst for structural change

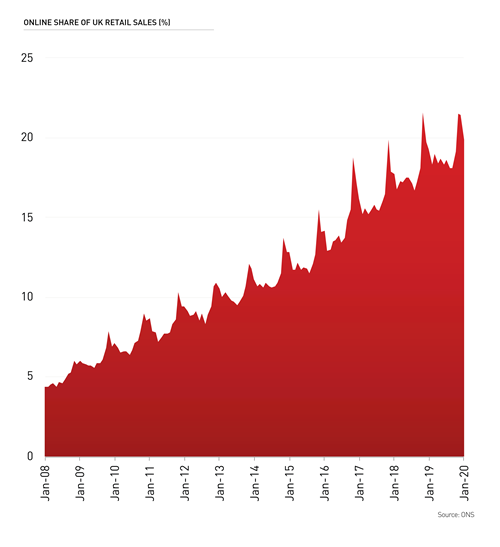

The longer-term legacy of Covid-19 may be an acceleration in behavioural changes that were already affecting the structure of the commercial property market. The trend towards flexible and home working may be hastened, primarily impacting the office sector. Social distancing may speed up the decline of high street retail and leisure activity.

Conversely, the relentless rise of eCommerce, which has driven logistics market growth in recent years, may be given further impetus. The coronavirus could cause on line’s share of retail sales to surge to new high, as consumers stay at home and opt to shop online in response to stock shortages in supermarkets or high street outlets.

Indeed, Amazon has reportedly had to ask its staff to work extra hours to cope with a spike in demand from customers making online orders during the coronavirus pandemic. Products such as bleach, hand-wash and nappies are said to be among the most in-demand items.

Any absolute rise in online sales may be a short-term effect, as all retailers will be negatively impacted if consumers have to tighten their purse strings during a serious recession. However, the coronavirus could further condition consumer behaviour towards online activity. It may normalise the online purchase of essential household items which many consumers would previously only have considered buying in shops.

Swift policy response

The speed and scale of the policy response to Covid-19 has underlined the seriousness of its economic threat. Emergency interest rate cuts have been made by central banks globally, including the Bank of England. However, with rates already at or close to record lows, central banks have more limited monetary policy ‘firepower’ available to them than during the last global recession.

The onus is on the government to provide a huge fiscal response to support businesses and protect jobs through the worst of the pandemic. In March, the government announced an unprecedented package of state-backed business loans worth £330bn – equivalent to 15% of the economy.

Further bold measures will be needed throughout the crisis. A 12-month business rates holiday has been announced for the retail, leisure and hospitality sectors, but there may be growing pressure to extend this to other commercial property occupiers.

Brexit’s not gone away

With the coronavirus dominating headlines, it would be easy to think of Brexit as a historical issue. However, as it stands, December 2020 is still the deadline for the UK and EU to agree a trade deal. It is hard to imagine that trade negotiations will be a priority for the UK government or the EU during the coronavirus pandemic, so an extension to the negotiation period cannot be ruled out.

By the end of 2020, it is to be hoped that the world is through the worst of Covid-19, economies are in recovery mode and the UK can get back to its national pastime of arguing about Brexit. However, there may be extraordinary economic upheaval before we get to this point.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email