Despite the reopening of retail and leisure, the fallout from COVID-19 will hasten change and consolidation, with the list of retailers announcing job cuts growing daily. However, government support and major reforms in planning have the potential to promote change for the better.

RETAIL REOPENS

Since mid-June, non-essential retail, restaurants and pubs have been gradually reopened across the UK, subject to social distancing measures. Most leisure facilities and tourist attractions reopened in early July (including cinemas, museums and theme parks), followed by theatres, casinos and bowling alleys on 15 August. It has been mandatory since 24 July for shoppers to wear face coverings in most parts of the UK.

Although there has been an inevitable uplift in both sales and footfall since lockdown, the impact of COVID-19 has been to accelerate the many existing trends impacting on both the retail and commercial leisure sectors. The fallout will be long-lasting and likely irreversible to some degree.

Several big-name retailers have already begun to announce significant job cuts, among them Marks & Spencer, which plans to cut 7,000 jobs over the next three months, John Lewis has warned 1,300 jobs are at risk, Boots said 4,000 job could be lost, and WH Smith may shed up to 1,500 jobs.

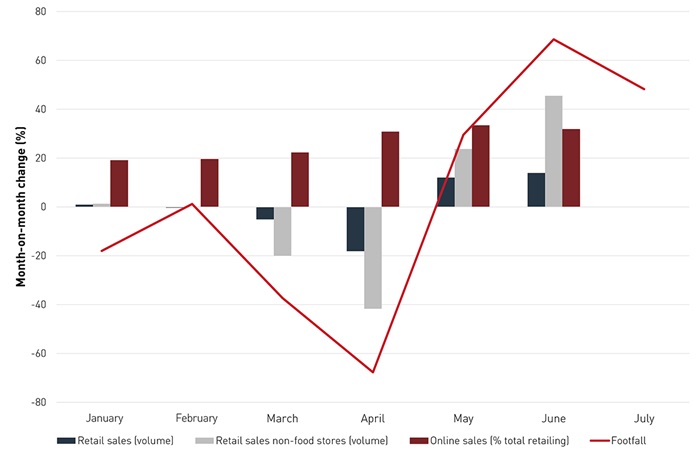

Positively, the ONS reported an increase of 13.9% in retail sales in June 2020 compared with the previous month and overall sales have returned to approximately pre-pandemic levels. Even more positive is that non-food retailers (fashion, homeware, furniture etc.) sales volume increased by 45.5% month-on-month in June.

According to Springboard, footfall increased by 48.2% month-on-month in July although it remains around 40% down on the same period last year. Footfall increased only modestly week-on-week during the first week of mandatory face coverings in England, suggesting that the policy may be dissuading people from shopping in-store although the wet weather will also have had a negative impact.

RETAIL SALES AND FOOTFALL MONTH-ON-MONTH CHANGE 2020 (%)

Source: ONS & Springboard

GOVERNMENT SUPPORT

Alongside the reopening of shops and other businesses, the Government’s ‘Eat Out to Help Out’ Scheme offers a 50% discount at cafés and restaurants (to a maximum of £10 per person) from Monday-Wednesday during August. The aim is to boost the hospitality sector and entice consumers back into commercial centres; although the unintended consequence of this scheme could be to reduce eating out and spend on other days of the week and particularly weekends.

The Government has also made additional support packages available for cities and town centres to develop action plans, help revitalise high streets, ensure consumers feel safe and protected during their shopping experiences, and to create temporary public realm changes. For example, £50m has been made available through the Reopening High Streets Safely Fund in England, and £11m through the Capital Covid-19 Recovery Revitalisation Scheme in Northern Ireland.

BUT IT’S TOUGH OUT THERE

Despite the reopening, online continues to account for a massive 31.8% of retail sales in June, more than 50% up on February’s level. While the online share is likely to dip as consumers tentatively embrace the high street again, it is likely that a large, additional proportion of spend has moved permanently online in the wake of the crisis.

According to the BRC, retail vacancy rates increased for the eighth consecutive quarter in Q2 2020 to stand at 12.4%. Of great concern is the fact that some retailers have announced store closures since the easing of restrictions, as they seek to rapidly reduce their focus on retail space and move to online. Recently, John Lewis announced it would not reopen eight stores, Tui confirmed 166 store closures and Eason said that it will not reopen its seven stores in Northern Ireland. Pizza Express have also announced that approximately 15% of their restaurants will not reopen. Should this trend continue, vacant retail space could surge.

For many retailers, the lockdown was the final straw in their bid for survival. The number of retailers going into administration or entering a CVA in the first half of 2020 surpassed the total for the whole of 2019, and more retail casualties are expected before the year-end.

ADMINISTRATIONS AND CVAS 2007-2020

Source: Lambert Smith Hampton & Centre for Retail Research

TURNOVER RENTS AS THE NEW NORMAL?

The disruption from COVID-19 is already starting to radically alter the traditional status quo between landlords and tenants. Landlords are adapting to the more challenging climate for occupiers with an increased offering of turnover-based leases, which are commonplace in the USA and Europe. Major landlords, including The Crown Estate, L&G and Capco have recently announced restructuring of lease terms, including offering turnover-based rents to assist current tenants and boost occupancy.

This sharing of risk and reward between tenants and landlords will provide significant levels of relief for retailers and hospitality operators. The increased adoption of turnover-based rents may well embed itself into the UK retail landscape and become the new normal for commercial retail leases.

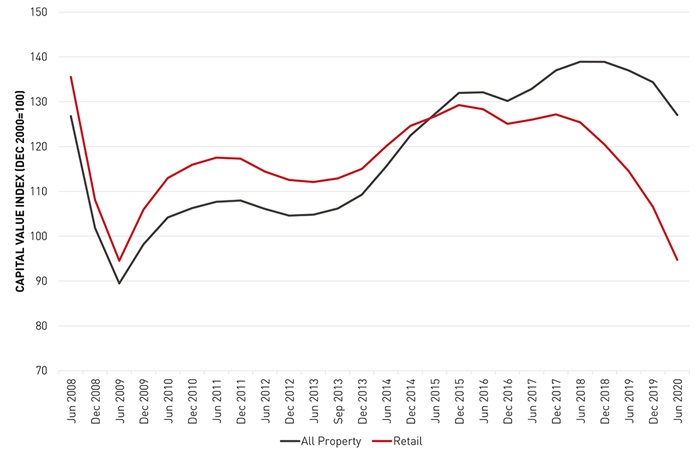

There are, however, questions for retail investors. According to MSCI, retail has been hit hardest by the lockdown, with capital values falling by 11.9% in the five months to July, compared with 6.2% for All Property. The recent slump takes UK retail values back to their low point in the last cycle in 2009. While the rebasing of rental levels and introduction of turnover rents will work to safeguard the best quality space in proven locations, in many cases change of use is likely to provide a better solution to restoring value.

ALL PROPERTY AND RETAIL CAPITAL RETURN

Source: MSCI

THE END OF RETAIL DEVELOPMENT?

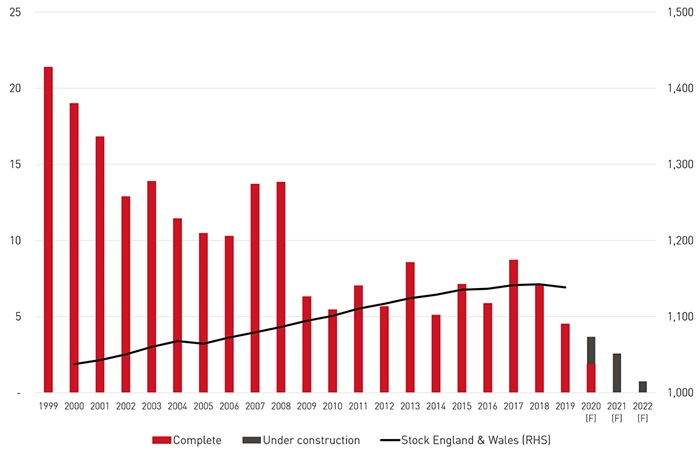

The global financial crisis, changing consumer behaviours and more recently the pandemic have seen retail development plummet over the past decade. Just under 4m sq ft of retail floorspace is expected to be completed in 2020, a far cry from the 22m sq ft of floorspace in 1999.

Notably, what little development is completing in 2020 largely comprises retail parks and leisure schemes, including The Times Square, Warrington (300,000 sq ft) and Bourne Place, Sittingbourne (267,000 sq ft). Also, reflecting extreme caution in the sector, a number of planned developments are now on hold, including Tamworth Junction Shopping Centre, Tamworth (225,000 sq ft) and the extension to Touchwood Shopping Centre, Solihull (115,000 sq ft).

UK RETAIL DEVELOPMENT AND ENGLAND AND WALES STOCK (M SQ FT)

Source: Lambert Smith Hampton, Trevor Wood Associates & VOA

FROM RETAIL DEVELOPMENT TO REDEVELOPMENT OF RETAIL

There can be no doubt that the impact of COVID-19 is accelerating the need to revitalise the UK’s high streets and redevelop non-performing retail space. It is also apparent that the high-water mark of UK retail floorspace has passed, and stock is set to experience a long period of gradual contraction and transformation. This will lead to increased pressures on the vitality and viability of many of the UK’s struggling high streets and towns that are currently over-shopped and over-reliant on retail.

In response to these challenges, and the longstanding objective to build more homes, the Government has set in motion some of the most radical proposed reforms to the planning system in England witnessed in generations. Alongside the recent publication of the Planning White Paper and amendments to Permitted Development Rights (PDR), the reform of the Use Classes Order will come into effect from September 1st 2020.

LSH’s recent viewpoints describe the UCO reforms and Planning White Paper in more detail.

In brief, retail uses (previously defined as Class A1) are now incorporated in a new Class E, along with: financial and professional services (A2); restaurants and cafés (A3); offices, R&D and light industry (B1); gyms (D2); and medical/health services, nurseries and day centres (E). From the beginning of September planning permission will not be required for change of use within the new broader Use Classes unless explicitly stated.

Robert Jenrick (Secretary of State for Housing, Communities and Local Government) has confirmed that the intention of the UCO reform is to “support the recovery and reimagination of our high streets and towns”. The reforms should certainly help landlords and investors who are seeking alternative uses for their failing retail portfolios. For example, plans have recently been approved to convert two-thirds of Westfield’s House of Fraser store in London into co-working office space. Elsewhere shopping centre owners are actively reviewing and promoting the redevelopment and repurposing of failing assets.

TURNING DISRUPTION INTO OPPORTUNITY

Looking ahead, occupiers, landlords, investors and local authorities who have invested in, and are committed to the future of our towns and high streets will undoubtedly endure additional challenges in the coming months and years. That said, there are potential bright spots on the horizon.

In the post-COVID world, successful town and city centres will be characterised by less retail space, but this contraction and consolidation should result in better quality, more varied, and more experiential uses and activities.

There will also be the need for a greater range of high street based services and community uses to meet the demands of growing town and city centre populations, particularly as redundant space is repurposed and redeveloped as homes. Many smaller local retail centres could also flourish as they serve increased numbers of home workers, and more attention is paid to the specific demands of individual local communities.

Beyond the planning reforms and the redevelopment of retail space, pre-pandemic Government funding schemes (including the Future High Streets Fund, the Towns Fund and City Deals) provide opportunities to kick-start the regeneration of some centres and high streets over the short to medium term. However, not all centres will benefit from these new funds, meaning that different and creative approaches to the funding and delivery of town centre revitalisation and regeneration will need to be identified.

There is also the need now for all local authorities to re-examine their action and master plans in light of the impacts of COVID-19 and the accelerated decline of high street retail. Working in partnership with the private sector, stakeholders and the community, new visions and plans are needed to help create towns and high streets that are fit for the 21st Century. Now is the time to turn disruption into opportunity, to help drive the post-pandemic economic recovery.

NEXT STEPS

We are advising occupiers, landlords, investors and local authorities on their response to the current challenges and will shortly be launching our Roadmap to Recovery guide; a three-stage action plan highlighting the key drivers and enablers to transform troubled high streets.

To receive a copy of the guide direct to your inbox or to find out more about our retail solutions, please get in touch.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email