Outlook: a break from Brexit

While uncertainty will surely ramp up again later in the year, the UK economy and property market head into the new decade on the front foot.

UK ECONOMY

POST ELECTION BOUNCE?

While Brexit polarises opinion, December’s resounding election result prompted a collective sigh of relief across the markets.

After three years of political wrangling, it means the UK is now effectively destined to leave the EU, and affords businesses and households some clarity over the broad outlook for domestic policy.

Accordingly, growth should pick up in the coming months, as decisions hitherto put on hold can now be followed through.

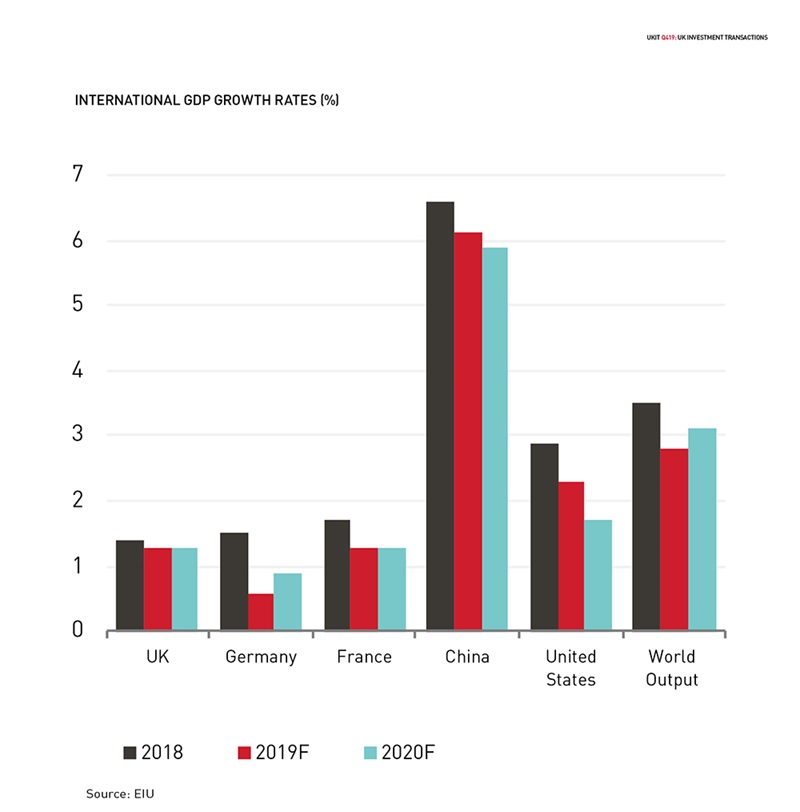

Pantheon Economics expect UK GDP growth to average 0.4% over Q1 and Q2, up from a sluggish average of only 0.2% over 2019, reflecting improving corporate activity and capital investment.

HOPE FOR CONSUMERS

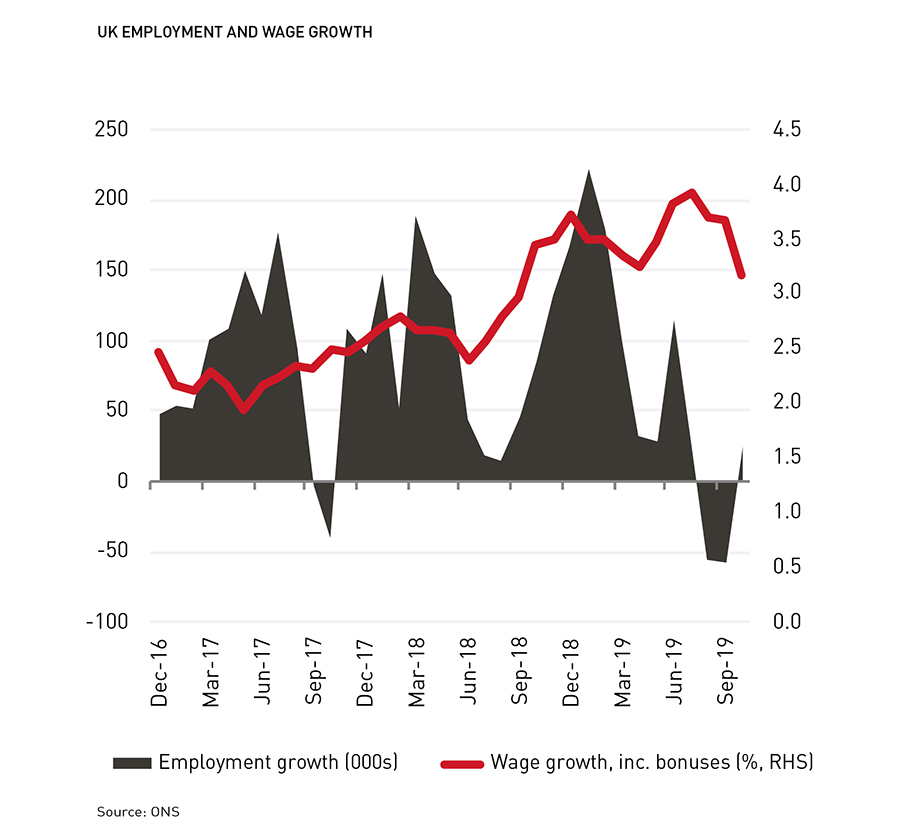

Some of the shine came off the UK labour market in latter 2019; UK employment growth lost momentum and the number of job vacancies dropped by 7% in the year to November. However, continuing growth akin to recent years is unsustainable in an economy boasting near full employment.

While BRC reported 2019 as the ‘worst year on record’ for the UK high street, the environment remains relatively positive for consumers. Wage growth is slowing but looks set to continue to outpace inflation, which will be kept low by sterling's recent appreciation. A sharp fall in mortgage rates over the last six months will also help to boost households' disposable incomes.

JURY’S OUT ON MPC’S NEXT MOVE

Nevertheless, negative economic data readings at the end of 2019 have underpinned a more dovish stance from the Bank’s Monetary Policy Committee (MPC). While market expectations as at mid-January were for an imminent rate cut, the recent release of more positive data may encourage the MPC to keep its powder

dry; according to the latest PMI surveys, UK manufacturing and services saw their best month for more than a year in January.

UNCERTAINTY: ROUND 2

With ongoing geopolitical tensions and complex Brexit trade negotiations still to commence, 2020 as a whole may prove to be another bumpy year. A new deal must be agreed by year end, otherwise the UK faces the prospect of tariffs on its EU-bound exports. Another round of elevated uncertainty and negligible growth is a real prospect later in the year.Beyond 2020, most forecasting houses regard the government’s intended form of Brexit as a negative, impacting on the UK’s future trade with the EU. Yet Brexit’s ultimate impacts are difficult to discern. Indeed, in its ‘Ten surprises for 2020’, global investor Blackstone expects the UK to emerge as a winner from its exit from the EU, outpacing the continent for growth and inward investment.

=

PROPERTY MARKET

IMPROVING DEPTH TO ACTIVITY

In similar vein to the UK economy, December’s election result will help to revive investment activity in the first half of 2020. Stock delayed by the election and Brexit uncertainty will come to the market, while buyers’ and sellers’ pricing aspirations will be better aligned. However, in the second half of the year, activity could hinge on the progress of the trade negotiations.

Domestic institutional buyers will be key to the improvement in H1. The well-publicised run of redemptions on UK funds seen in late 2019 should encourage some into selective selling, while others in a more sanguine position have cash ready to deploy into property.

OVERSEAS BUYERS STILL KEEN

Brexit or otherwise, UK real estate will remain a major draw to overseas capital in 2020. While prime yields in many sectors stand at or near to historic lows, in a global context the UK offers relative value compared with other markets, while also providing the liquidity, security and transparency long-associated with

investing in the UK.

Having seen quieter activity than usual in 2019, the pricing and underlying occupier market dynamics in UK offices - particularly central London offices - will hold strong in 2020. The UK’s appeal will also broaden to include new overseas entrants, such as from Japan, South Korea and the Middle East.

SOLID RETURNS EXPECTED

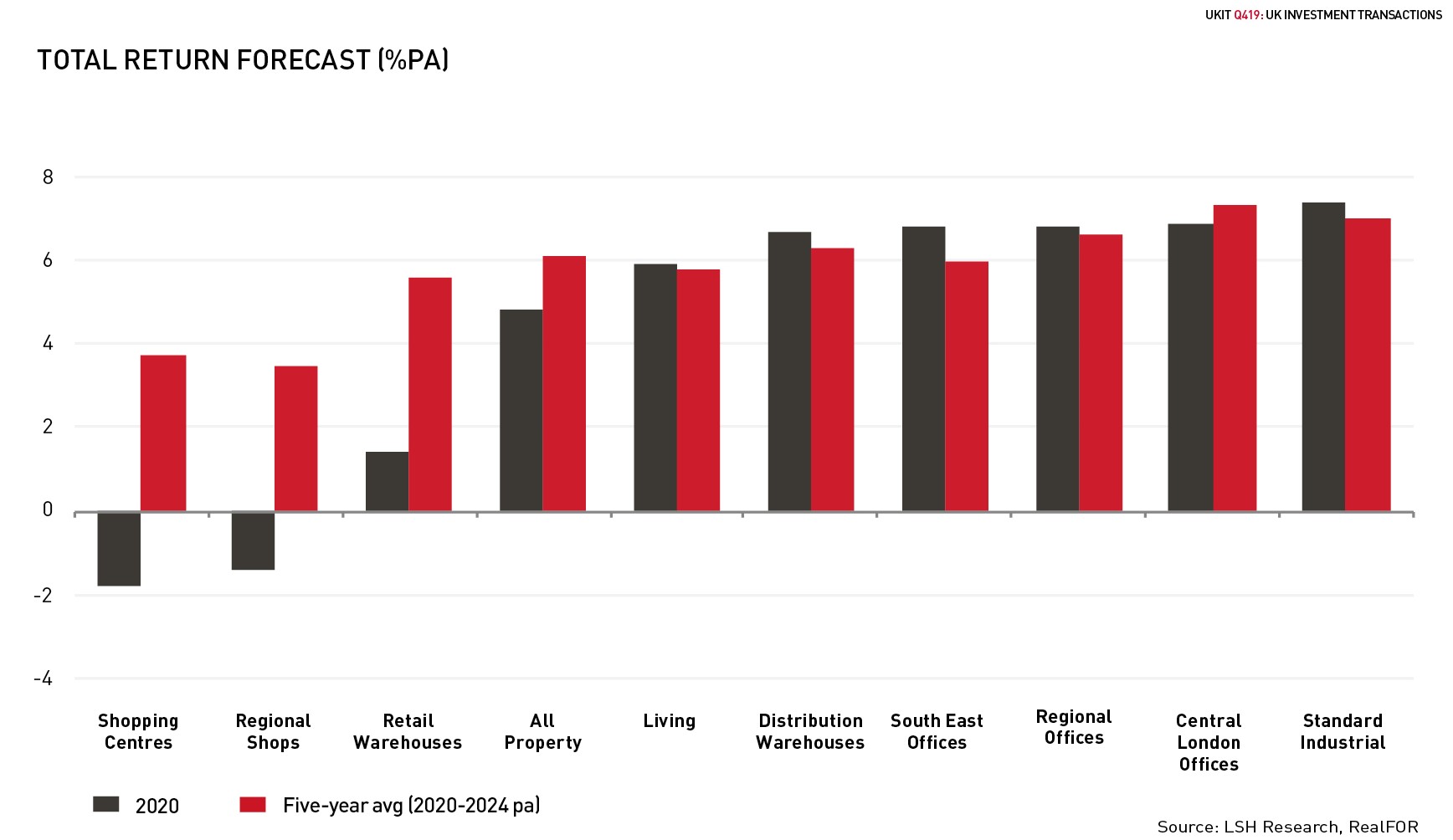

All Property total returns are likely to end up at a rather dispiriting 1% for 2019. This is not simply down to Brexit, but rather the ravages of structural change that have swept through UK retail. Annual returns for shopping centres and retail warehouses will be in the region of -15%, dragging on All Property’s performance.

Office and industrial have posted solid returns in 2019, driven by income and a degree of rental growth. With prospects for renewed yield compression off the agenda, this pattern is expected to continue in 2020, with generally tight supply in the office markets continuing to offer scope for value-add seeking investors.

LIVING TICKS THE BOXES

As seen throughout 2019, an ongoing weight of global capital for secure long-income will continue to fuel strong demand for prime assets, particularly in the living arena, which are characterised by longer leases and large lot-sizes. The main impediment to volumes across the likes of student accommodation and healthcare may prove to be stock levels.

EXPLOITING STRUCTURAL CHANGE

News of another disappointing year for Christmas trading caps an ‘annus horribilis’ for the UK high street. While values will remain under pressure in 2020, the sector is looking increasingly ripe for re-positioning, either through wholesale redevelopment or reconfiguration to a broader mix of uses, such as leisure and work space. Indeed, with the right due diligence and local market knowledge, these assets potentially offer some of strongest return opportunities at this late stage in the cycle.