Outlook: recovery starts here

Efforts to contain a second wave of COVID-19 infections in Q4 are likely to see a fuller return to activity postponed to 2021. However, falling values in the interim drive significant opportunity for change.

FADING HOPES OF A V-SHAPE

The pace of the post-lockdown economic recovery has slowed, with monthly GDP growing by 2.1% in August, following growth of 9.1% in June and 6.4% in July. As a result, GDP remained 9.2% below February’s pre-lockdown level. The weaker growth in August came in spite of the significant boost to the hospitality sector from the Eat Out to Help Out scheme.

Disappointing growth and fresh COVID-19 restrictions have put the prospect of a ‘V shaped’ recovery into serious doubt.

New restrictions aimed to quell a second wave of infections will impact activity in Q4, particularly in the hospitality sector and in those regions affected by more stringent measures.

Pantheon Macroeconomics now forecasts that GDP will still be around 7% lower than the pre-pandemic level in Q4.

GROWING LABOUR PAINS

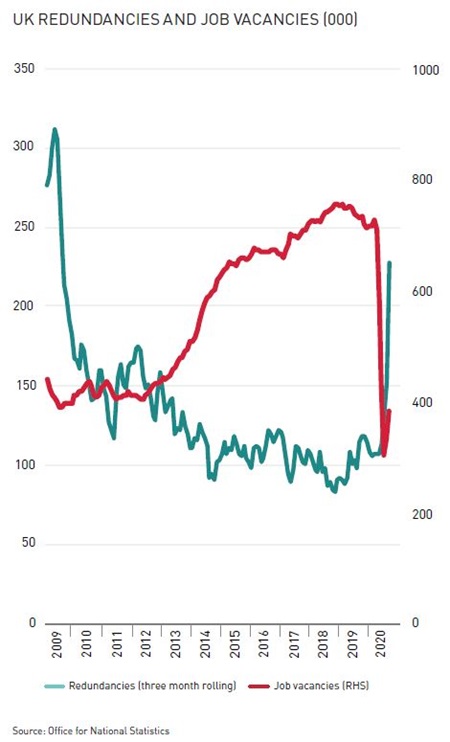

The impact of COVID-19 is also visible in the labour market data. The UK unemployment rate rose to 4.5% in the three months to August, up from 4.0% in the previous quarter.

In the same period, redundancies more than doubled to 227,000, the highest total since 2009. Redundancies are expected to peak as the furlough scheme is wound up at the end of October, with the Institute for Employment Studies forecasting 650,000 redundancies in H2.

August’s lacklustre GDP data adds to the likelihood that the Bank of England’s Monetary Policy Committee will seek to support growth by extending its quantitative easing (QE) programme at its November meeting. The Bank has also indicated that it is open to the idea of negative interest rates, albeit these are not widely expected before the end of 2020.

KICKING THE CAN

Fresh restrictions, a slower recovery and ongoing uncertainty will continue to weigh on occupier and investor decision-making towards the year-end. While Q4 volume is expected to improve again on Q3’s level, many investors and lenders will simply opt to sit on their hands and focus on more immediate concerns around rent collection and securing income on existing assets. At the same time, debt-reliant investors will be discouraged by ongoing risk adversity amongst lenders.

If not for COVID-19, Brexit would no doubt be commanding far more attention than it has of late. At the time of writing, uncertainty still surrounds the terms of the UK’s exit from the EU, giving investors even more of a reason to hold fire.

That said, should greater clarity emerge in the coming weeks, it has the potential to drive greater confidence around valuations and stimulate activity early next year.

UNPRECEDENTED POLARISATION

In a cruel twist of fate, COVID-19 has served to accelerate polarisation across the market to an unprecedented level: between prime and secondary assets and between the sectors themselves. In a world of rock-bottom interest rates and a strong global weight of money for core real estate, assets at the top end of the spectrum, including secure long-income product and good quality industrial and logistics assets, have and will continue to attract strong demand and keen pricing.

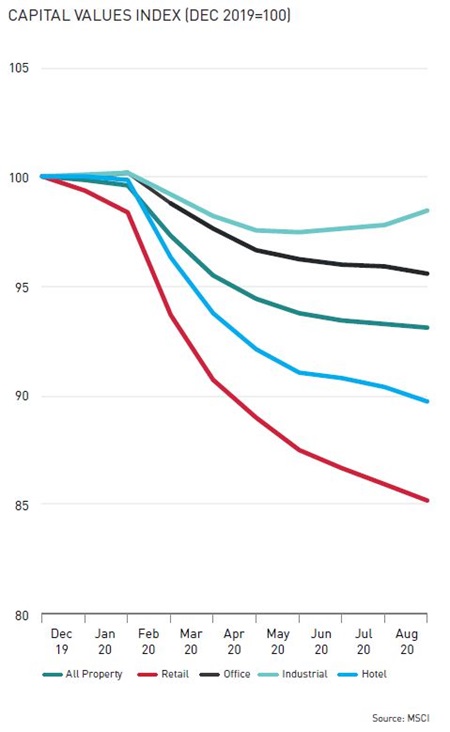

At the other end of the spectrum sits the beleaguered retail sector. In some respects COVID-19 will come to represent the final nail in the coffin for many retailers and indeed a host of retail assets. According to MSCI, average UK retail values have fallen by 15% over 2020 to date, compared with only 1% for industrials. That said, value is undoubtedly starting to appear in the sector, and well-let assets with future alternative use potential are proving increasingly attractive to yield hungry buyers.

TESTING TIMES FOR THE CAPITAL

There is a peculiar geographical dimension to the fallout from COVID-19. While London’s global safe haven status remains secure, the pandemic is proving to be a major test.

A sharp reduction in visitor numbers, travel limitations and persistently high levels of remote working have, frankly, pulled the rug from underneath Central London, and it is reasonable to envisage the capital’s pricing premium over elsewhere in the UK start to erode.

Even when COVID-19 is dealt with, there is a growing sense that the expense and commuting effort associated with Central London offices leaves the sector relatively exposed to change. Weak demand is already feeding through into softening incentives while, in the longer term, occupier efforts to reduce cost via greater use of remote working could drive vacancy rates up and rents down.

PLANNING FOR CHANGE

The ultimate legacy of COVID-19 for the property market will be an acceleration of structural changes that were already underway in the occupier markets. Investors that can intuitively see where changes in the market translate into opportunity have real potential to create added value. Residential is a key area, where, notably, the dynamics of demand and supply have remained broadly unchanged throughout the pandemic.

To this end, the Government’s proposed reforms to the planning system (comprising an overhaul of the Use Classes Order and extensions to permitted development) have the potential to fast-track change and drive the breadth of opportunity in the market. If the reforms are put into law, investment activity around change of use could form the core of many investor strategies over the coming years.

Get in touch

Email me direct

To: