Getting back on track

While recent events have put investors onto the backfoot, a groundswell of demand is ready to be unleashed into the UK industrial market. The knock to sentiment is likely to be short-lived, with sound fundamentals in the occupier markets underpinning the sector’s continuing outperformance.

A GOOD YEAR IN THE WIDER CONTEXT

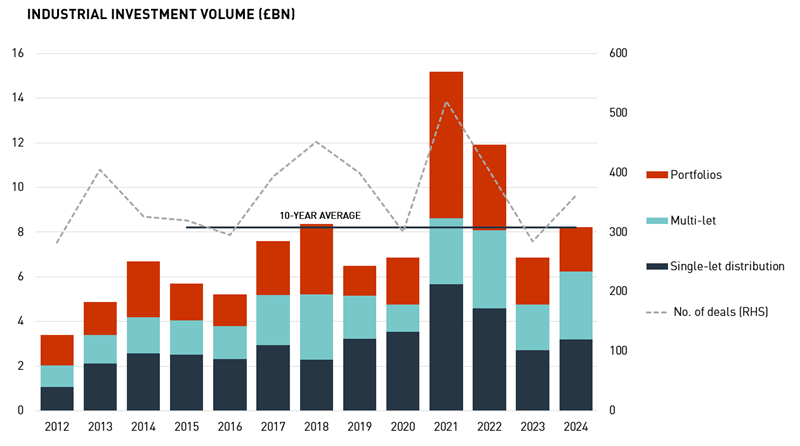

Amid a challenging year for the UK economy in 2024, the industrial and logistics investment market performed well in terms of activity and returns. Total volume hit £8.2bn in 2024, rebounding by 20% on 2023’s six-year low and the fourth highest outturn on record. A strong finish to the year was key, with Q4 volume of £2.7bn the first £2bn+ quarter since the severe correction took hold in Q3 2022.

Industrial and logistics accounted for 33% of the combined volume across the UK’s three core commercial sectors in 2024, significantly ahead of the long-run annual average of 19%. Tellingly, industrial volume also ran ahead of offices for the first time ever in 2024, reflecting comparatively weak investor sentiment in that sector.

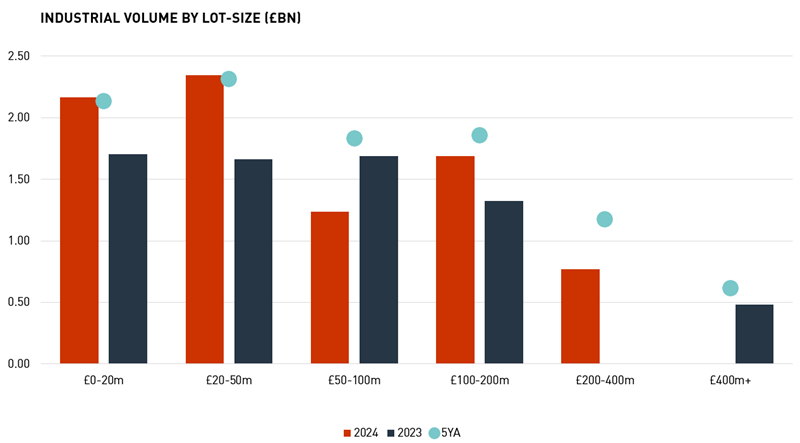

Activity also improved more markedly than volumes, with 2024’s 361 deals up 28% on 2023. However, large-scale transactions remained thin, certainly compared with the boom of 2021/22. 2024 yielded only three deals over £200m, the largest being Lone Star’s acquisition of the Tiger Portfolio in Q3, which included c. £360m of industrial assets.

Source: LSH Research

Source: LSH Research

HUNTING GROWTH

The underlying make-up of 2024 volume differed from prior years, especially compared with the boom of 2021/22. At £3.9bn, distribution warehouse volume was identical to 2023 and, for the first time since 2018, it accounted for less than half the annual total. In contrast, UK multi-let volume of £4.4bn rebounded by 46% on 2023 and was 20% above the five-year annual average. This included a record quarter for South East multi-lets, with Q4 volume of £787m boosted by two £100m-plus deals.

The changing pattern partly reflected lower appetite for core income and a shift towards assets offering growth potential. In the current market, core income does not meet the IRR aspirations of many investors, driving a greater focus towards reversionary potential. The opportunity to drive rents is more commonly associated with the multi-let market, although single-let logistics with near-term expiries have also attracted keen demand in proven locations.

VOLUME BACK ON TRACK AFTER SUBDUED Q1

A fresh bout of uncertainty clouded the investment market in the New Year, with a negative reaction to the Government’s budget and a global bond market sell-off in January pushing many investors into wait-and-see mode. Limited openly marketed stock and cautious appetite, particularly on large lot-sizes, is expected to result in subdued volumes of little over £1bn in Q1.

However, investor requirements have been delayed, not extinguished. Bond yields have retreated from the 15-year high seen in mid-January, with the markets further reassured by a 25bp cut in the bank rate to 4.50% in February. Renewed expectations of further falls to bond yields and several additional 25bp cuts to the bank rate over the next 12 months should help to restore investor sentiment. Factoring in a tepid Q1, total volume is expected to hit £8.0bn in 2025 overall, closely in line with 2024’s total.

OVERSEAS BUYERS DRIVING THE MARKET

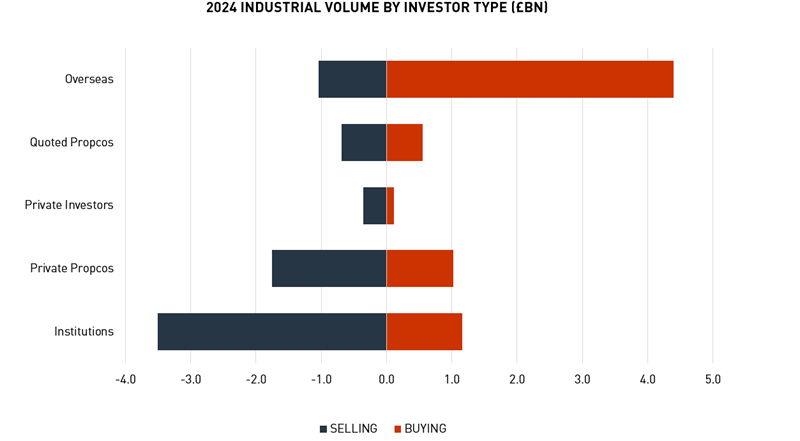

Overseas investors continue to drive volumes, a trend expected to continue in 2025. Total overseas purchases amounted to £4.4bn in 2024, with strong net-buying of £3.4bn standing 55% higher than 2023. They remain dominant at the larger end of the market, behind 16 of 2024’s largest 20 deals, while North America dominated once again, accounting for three-quarters of overseas inflows.

2025 promises to be no different, with overseas inflows forecast to account for approximately 60% of volume for the year. The pound’s retreat against the dollar adds to the allure for North American buyers. Alongside existing players such as Blackstone (through its various vehicles), Ares, IGC, GIC and EQT Exeter, many notable new and/or returning investors to the market have substantial capital to deploy, collectively running into the billions, including Sixth Street, Aermont, Australian Super and Mapletree.

Source: LSH Research

INSTITUTIONAL SELL-OFF TO CONTINUE

UK institutions have been a key source of stock for hungry overseas appetite, with their reducing exposure partly stemming from fundamental changes to defined benefit pension schemes. Institutional net selling hit a record £2.3bn in 2024, more than twice 2023’s previous high, with major sellers by volume including Abrdn, with £557m of disposals, and L&G, with £384m of disposals.

It has not all been one-way traffic, however, with institutional buying of £1.2bn in 2024 up 15% on 2023’s 15-year low. 2024 saw c.30 unique institutional buyers in the market, the most active including M&G, behind four acquisitions, and CBRE IM, behind 10. However, institutional interest has been more focused on the multi-let market, reflecting less competition from overseas capital and a drive to maximise income through reversions.

The trend towards institutional net-selling is set to remain in 2025, with significant flux in the pension funds environment continuing to shape activity and release stock. Redemption pressures are driving moves to consolidate, most notably the proposed merger of Federated Hermes PUT and L&G PF. Meanwhile, the Government’s intention to introduce ‘mega funds’ in years to come will increase the buying power of local authority pension funds.

M&A ACTIVITY TO DRIVE BUYING OPPORTUNITIES

M&A activity has featured notably in the listed space of the industrial market, again reflecting some of the pressures over recent years. Custodian REIT, Urban Logistics REIT and Warehouse REIT have all been subject to merger discussions in recent months, and 2025 may well see some of these funds combine forces. The establishment of new, larger vehicles will drive scale, potentially paving the way for new strategies of disposals and acquisitions.

While overseas investors dominate on the acquisitions, they may provide a key source of buying opportunity over the year ahead. A number of major overseas buyers of UK industrials from four to five years ago may come under pressure to crystallise their gains and/or recycle capital towards new business plans. This area is likely to be key in driving the arrival of several major UK portfolios back onto the market over the next 12–18 months.

STRENGTH THROUGH STABILITY

Industrial continues to outperform. According to MSCI’s quarterly index, UK industrial recorded respectable average total returns of 8.3% in 2024, narrowly edging out retail to lead and comparing with 5.5% for All Property. Remarkably, 2024’s result marked a seventh year of outperformance from the last eight years. A strong finish to the year was key, with capital growth jumping to 2.0% in Q4, the strongest quarterly rise in values since Q2 2022.

Performance varied between industrial’s three key sub-sectors. For a third successive year, distribution warehousing marginally underperformed the wider industrial market, with average total returns of 7.3% in 2024. Meanwhile, regional multi-lets outperformed for a second successive year, with average total returns of 9.9% underpinned by slightly stronger capital growth and higher income returns relative to the other sub-sectors.

Source: LSH Research

Source: LSH Research

GETTING BACK ON TRACK

Our assumptions for the year ahead are rooted in a gradual improvement in financial conditions, following January’s spike in bond yields. While Capital Economics recently revised down its forecast for UK GDP growth to sub-1% in 2025, this may support the case for additional rate cuts over the coming year, to a terminal point of c.3.50% in early 2026. This forecast offers hope for investors, but the promise of better conditions and cheaper finance in the future, alongside uncertainty over whether this scenario will play out, is shackling commitment among both vendors and buyers today.

OUTPERFORM TO CONTINUE

Based on the above scenario, the industrial sector is forecast to continue to outperform over the medium term, albeit to a marginal level against the other core sectors. Latest figures from RealFor predict UK industrial returns of 8.4% per annum over the period from 2025 to 2028, running marginally ahead of All Property, where returns of 8.0% are forecast.

The main driver behind industrial’s ongoing outperformance is a continuation of rental growth, with RealFor forecasting UK industrial growth of 3.1% per annum up to 2028, compared with 2.5% for All Property. And, reflecting stronger rental growth forecasts for the London area, returns are expected to be led once again by London estates, with forecast average returns of 9.5% per annum over the period.

EXPECT FURTHER BIFURCATION

The above forecasts are conservative and based upon the average position across a range of assets in terms of location, size, and quality. Given the focus of demand towards high-quality, future-proofed assets, increasing bifurcation in performance can be expected, particularly as increased void risk is attached to un-refurbished secondhand assets.

As a result, performance will inevitably vary at the asset level, both above and below the average forecasts. At the prime end of the market, a degree of yield compression may be expected before the end of 2025, assuming the improvement in finance costs is sustained, reflecting more competitive bidding and aggressive acquisition strategies from new entrants. The promise of yield compression may also help to tempt more landlords into disposals, supporting activity and volumes.

Source: LSH Research

CAUTIOUS INTEREST IN SPEC FUNDINGS

A rebasing of land values, relative stability in build cost inflation and, crucially, improving finance costs have all helped to restore a degree of investor appetite for spec fundings over the past year. Despite the recent knock to sentiment, several spec fundings are presently under offer, albeit focused in the multi-let and smaller end of the big box market, examples including Barings, Cabot, Indurent, JD.com, Logicor, M&G and Mirastar.

Appetite for spec fundings is, however, likely to be cautious over the year ahead, with hopes of improving conditions in the debt markets offset by increasing nervousness around void risks. This approach does offer a good route to gaining exposure in the UK market and is therefore likely to be led by new overseas entrants, provided the risks are adequately accounted for at the appraisal stage.

Get in touch

James Polson

Executive Director - National Head of Industrial and Logistics

Email me direct

To: