IFRS 16 – rarely, in the property valuation arena, has a combination of just four letters and two numbers, both been so long heralded and much dreaded!

Background

Now, I must be completely up front at the outset. Although a RICS registered valuer with over 35 years’ experience and whose current role is focussed on capital accounting valuations for public sector clients, I have not yet undertaken a valuation under IFRS 16. Based on a straw poll taken in the room at a regional ACES meeting this summer, I suspect many of you reading this are in the same boat. I do, however, have a clear understanding on the property valuation requirements and believe this paper will steer your estates and finance teams in the right direction.

Whilst the time frame for mandatory application has been deferred, the messages are clear that all local authorities who have not already done so, must reflect the requirements of IRFS 16 in the valuation of their property assets in the 2024-2025 financial year, the start of which is now less than six months away.

The intention of this article is to provide, from a valuer’s perspective:

- an introduction/refresher to IFRS16;

- a summary of the processes; and

- practical guidance and tips

which together should assist in preparing a valuation under this accounting standard.

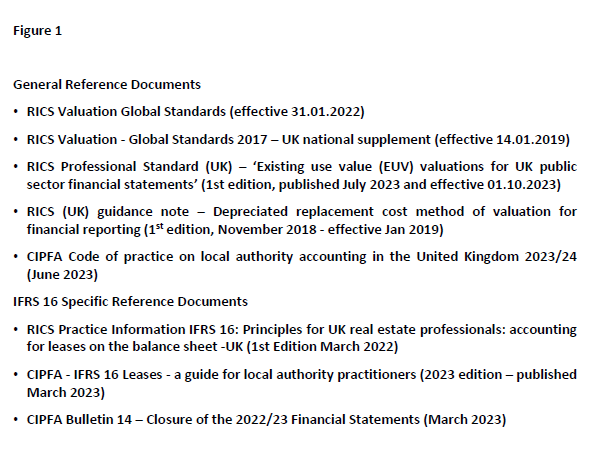

Key points of reference:

Before we get started, in Figure 1 (below) I list the key documents (as at September 2023) which a valuer should have regard to in preparing a valuation under IFRS16 (for the current financial year), distinguishing between those generic to asset valuations and those specific to assets captured under IFRS 16.

Non-freehold property assets - the pre IFRS 16 (current) position:

A local authority (‘the entity’) under previous arrangements (IAS 17) has been able to classify property assets held by the entity as lessee (i.e. on a non-freehold basis including licences, tenancies at will, and undocumented tenancies, in addition to formal leases) as either finance leases or operating leases.

Finance leases, typically long term (virtual freehold/ground leases), have to be recognised on the balance sheet and so subject to periodic formal revaluation. Operating leases, usually what we might consider occupational leases with contractual terms of less than 30 years and including all short term leases/licences etc., do not. Therefore, a minority only of the entity’s ‘non-freehold’ estate is ‘on-balance sheet’ and requires regular revaluation.

IFRS 16 – the basics:

IFRS 16 is an accountancy standard relating to leases and tends to predominately be the domain of accountants and finance teams. It has replaced IAS 17 and introduces a single lessee accounting model. Under IAS 17, the entity had the ability to decide whether a lease was an operating lease (off-balance sheet) or a finance lease (on-balance sheet). The standard requires lessees to recognise assets and liabilities for MOST leases and has introduced the concept of Right of Use (RoU) assets.

IFRS 16 – the valuation process:

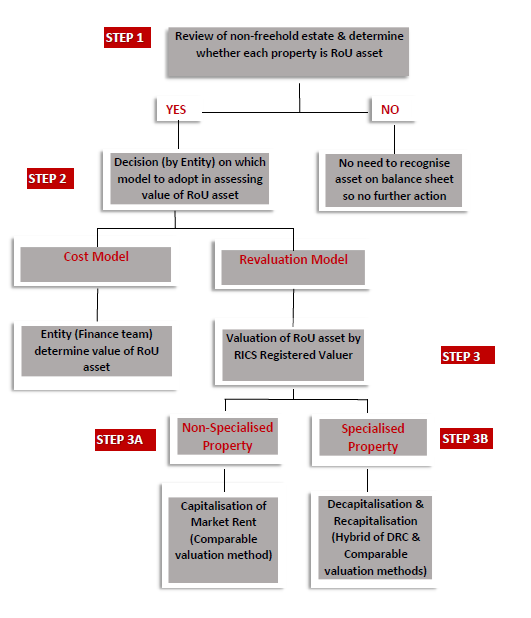

For the purposes of this paper, I have broken down the process of valuing an asset under IFRS 16 into three steps, further sub-dividing the final step reflecting the different recommended method of valuation in relation to specialised and non-specialised properties. I have set this out in a flow chart format as Figure 2 (below) and will now provide some details around each step/sub-step.

Step 1 – Review of non-freehold estate and determine whether each property asset is a RoU asset:

The initial stage in tackling IFRS 16 is for the entity to undertake a review of all its non-freehold property interests to decide which fall within the remit of the standard. This should ideally be through a project team of relevant internal staff from the finance and estates teams, with perhaps external consultant input. The entity’s external audits should be involved in this step.

This exercise should involve the collation and review of full data on existing ‘leases’ where the entity is the lessee and ideally result in the formalisation of any undocumented arrangements but at a minimum determine key assumed terms for all arrangements remaining undocumented. Only if an asset meets the criteria for a RoU asset, does it need to be ‘measured’ (valued) and recognised on the balance sheet.

IFRS 16 applies to all leases with some key exceptions. Exclusions (in relation to property, as identified by RICS) are service concession arrangements (i.e. PFI), short term leases and leases of ‘low value’.

In relation to UK local authority assets (as guided by RICS & CIPFA), a short term lease is defined as one with 12 months or less at the commencement date (this date is when the lessor makes the asset available for use and accordingly any rent free periods are considered irrelevant) and/or a tenancy with notice periods of less than 12 months. However, if a lease incorporates an option to purchase, even if it meets the above criteria, then it does not qualify as a short term lease. Any assumptions made regarding the exercise of any options to determine or extend should be based on operational requirements and likely scenarios.

As regards leases of low value, the standard does not include any definition in monetary terms but it is generally accepted as equivalent to $5,000 when new and to represent the value of underlying assets – it is considered unlikely to apply to property assets.

What qualifies as a lease under IFRS 16 can be clear i.e. written tenancy (lease or licence) forming contract (assuming exceptions don’t apply) and includes leases with nil consideration or peppercorn rents only. Of course, there will be grey areas when no documentation is in place/available and each situation should be considered on a case-by-case basis. Ultimately, the decision on whether an arrangement comprises a qualifying lease is the responsibility of the entity.

In this stage it is also appropriate to consider the definition of a RoU asset. A Right of Use (RoU) asset is defined as ‘an asset that represents a lessee’s right to use an underlying asset for the lease term’. The two key phrases identified in bold require further definition. An underlying asset is defined as ‘an asset that is the subject of a lease, for which the right to use that asset has been provided by a lessor to a lessee’. An important consideration is that the lessee must be able to both direct the use of the asset and receive substantially all of the economic benefits and/or service potential from use of the asset.

The lease term is defined as ‘the non-cancellable period for which a lessee has the right to use an underlying asset, together with both: a) periods covered by an option to extend the lease if the lessee is reasonably certain to exercise that option, and b) periods covered by an option to terminate the lease if the lessee is reasonably certain not to exercise that option.

The length of the lease term (as defined above, not any actual lease term) is a key factor in the valuation of a RoU asset (more on this later) and needs to be determined (and documented) by the entity for each asset reviewed.

Contracted-out leases, with no options to break or extend, provide greater certainty in assessing the remaining term. Otherwise, there is more uncertainty and the need to consider whether the entity would intend to renew under the Landlord & Tenant Act 1954 and so extend the term. The position is more challenging where ‘tenancies’ are informal and/or poorly documented.

Step 2 – Decide which model is to be adopted in assessing a RoU asset’s value:

IFRS 16 requires that, in terms of (in accounting terminology) subsequent measurement (the initial measurement, for our purposes valuation, at the commencement date is be taken at cost) of a RoU asset, one of two models is to be adopted, either the Cost Model or Revaluation Model. The expectation is that in the majority of cases the IFRS Cost Model will be the most appropriate model to adopt, as an approximate proxy for Existing Use Value (EUV) or Fair Value (FV), these two bases of valuation being applicable, as in the valuation of freehold assets for the same purpose, in relation to operational assets and all other assets respectively.

In terms of practical expediency, the Cost Model is to be used unless it is considered inappropriate. This model is likely to be deemed inappropriate where: 1) a longer-term lease has no provisions to update lease payments for market conditions (i.e. rent reviews), or there is a significant period of time between those updates and 2) the value (FV or EUV) of the underlying asset is likely to fluctuate significantly due to changes in market prices.

Conversely, utilisation of this model will usually be acceptable where: 1) a market rent is being paid, or 2) the term is short enough that material increases in value are unlikely to arise, or 3) there are regular rent reviews to market rent and property is not overrented. This model is not to be confused with the Depreciated Replacement Cost (DRC) ‘cost’ approach to the valuation of specialised assets and is to be used/applied by accountants, not valuers. Accordingly, I will refrain from considering this model in any further detail.

Step 3 - Assessing the value of a RoU asset using the Revaluation Model:

In respect of RoU assets where it is decided that the Revaluation Model is the most appropriate to be adopted, a suitably experienced RICS Registered Valuer (internal to the entity or an external consultant) should be instructed to produce a formal valuation. As a minimum, the Valuer will need confirmation of the lease term (determined by the entity) and a summary of the actual terms of the lease/tenancy.

The general principle is that RoU assets should be valued on the same basis that the underlying asset would be valued if it were owned by the entity i.e. EUV for operational PP&E, Fair Value otherwise. It is crucial however to understand that this valuation must only reflect the rights the lessee has acquired (RoU) and not the full value of the underlying asset. As a general principle, in undertaking a valuation under this model, the aim is to appraise what would be payable were the lessee to be deprived of the use of its lease and have to replace it with a similar asset under the same lease terms.

Different approaches are to be applied for Non-Specialised property and for Specialised Property (defined in the RICS Red Book as ‘a property that is rarely, if ever, sold in the market, except by way of a sale of the business or entity of which it is part, due to the uniqueness arising from its specialised nature and design, its configuration, size, location or otherwise’).

Step 3A– Application of the Revaluation Model to a Non-Specialised RoU asset:

In essence, the method to adopt is a capitalisation of Market Rent but beware this is not a valuation of a leasehold interest as we might know it i.e. capitalisation of any profit rent for period receivable. The passing rent is not to be used in this leasehold valuation.

In applying the market/comparable approach, one has to estimate the Market Rent (as at the valuation date and having regard to all the actual lease terms, except passing rent, rent review date and any rent concessions lease) of the underlying asset. The rent will require capitalisation, using an appropriate yield, for the remaining non-cancellable lease term (confirmed by entity). The current suggestion from the RICS is to use a single rather than dual rate yield (i.e. avoid use of sinking funds) as this best replicates the Cost Model approach.

The yield is to be derived from market evidence and it is suggested that good practice would be to start with establishing an appropriate freehold yield and adjust (increase) this to reflect the inherent less attractive nature of a leasehold interest.

On the question of tenant’s improvements, it is considered that these will not usually form part of the RoU asset, the notable exception being if such works have been completed under a lease obligation.

Step 3B– Application of the Revaluation Model to a Specialised RoU asset:

As with freehold/finance lease asset valuations of a property which is deemed to be ‘specialised’, the Depreciated Replacement Cost (DRC) is the most appropriate valuation method to adopt as a starting point. For the avoidance of doubt, a specialised asset is that for which there is an absence of an active market for the property. The general recommend approach is being termed ‘Decapitalisation and Recapitalisation’ which is a preferred approach as it mirrors that proposed for non-specialised RoU assets as discussed in Step 3A above (i.e. capitalisation of rental value).

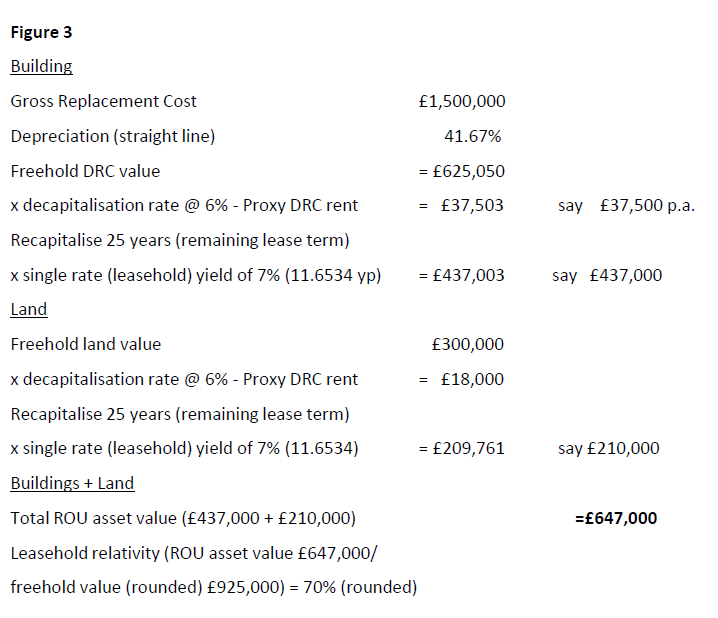

The methodology is to establish a rental value (a proxy DRC rental) and capitalise this for the remaining length of the non-cancellable lease term. The RICS has recommended a twin track approach whereby one determines separate rents for the building(s) and the land and then capitalises each, before aggregating the resultant figures to arrive at the total value of the RoU asset. Acknowledging the IFRS 16 specific nature of this valuation methodology, I have included, as Figure 3 (below) a worked example for illustrative purposes in relation to a notional operational premises.

Considering the building(s) first, we have to establish the DRC, as if it were held freehold, using the remaining life(lives) of building(s) unadjusted for remaining lease term, if shorter. We then decapitalise this (in the example using a rate of 6%) to obtain a proxy DRC rental value for building. Determining an appropriate yield will be challenging as, being classed as a specialised property, by definition there is no, or at least an insufficient, market and so you will need to base your opinion on consideration of a broad range of evidential indicators, ideally including nearest similar asset classes.

One then has to recapitalise the (proxy DRC) rent for the remaining length of the non-cancellable lease term using a yield which reflects an adjustment (in the example, applying 7%, an uplift of 100 basis points to the decapitalisation yield of 6%) to take account of the leasehold nature of the subject interest. The rounded product, £437,000 in the example, is the value of the building element of the RoU asset.

Secondly, is a rental assessment of the land. If possible, this should be determined by using any market rental evidence available relating to the prevailing land use in the locality. Otherwise, as in the worked example, one should apply the same decapitalisation principle (as used in valuing the building) to the capital value of the land (based on a comparable valuation considering relevant land types) to arrive at a market (proxy DRC) rent for the land. Finally, one has to recapitalise this rental figure for the same period as the building (25 years in the example). The same yields of 6% (decapitalisation) and 7% (recapitalisation) have been adopted in valuing the land as were used to value the building.

On the presumption that both elements form the constituent parts of the RoU asset then the two values are added together to produce the total RoU asset value, £647,000 in this example.

As is good general valuation practice, it is considered prudent to sense check the result and an appropriate measure is to consider the ratio of the RoU asset value to the freehold value of the underlying asset. This check in the example confirms a relativity of 70% and whilst what is a reasonable relatively range is highly subjective, especially acknowledging the fledgling status of this type of valuation work, I believe many valuers would feel this is reasonably reflective of the difference between the RoU and freehold interests given a 25 year remaining ‘lease term’, always mindful valuation is an art not a science!

Conclusion

I hope that as you finish reading this any concerns and uncertainty about the impact of IFRS 16 on asset valuations will have been reduced and I am confident that as valuers, we will all have a greater understanding of this emerging area of valuation within the public sector as we move, in solidarity, through the next 18 months and have come through the first financial year when IFRS 16 has been a mandatory consideration for local authorities in the revaluation of their property assets.

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email