WeWork’s emphatic debut into Birmingham is a major statement of intent and a clear vote of confidence in the city’s long term prospects as a business location. As structural change sweeps through the office market, landlords of more conventional offerings cannot afford to stand and watch.

Birmingham's flex phenomenon

In Q2, WeWork’s leasing of 226,000 sq ft

across three separate buildings in Birmingham

city centre was alone equivalent to over 70% of

total take-up in the quarter. As a proportion of

activity, Birmingham has also witnessed more

acquisitions from flex-space operators than

any other UK market over the past 18 months,

including Central London, amounting to well

over a quarter of take-up.

Why now? Why Birmingham?

The recent spike of flex-space activity in

Birmingham is linked to a perfect storm

of factors. In a rush to grab market share,

structural changes to the nature of occupier

demand have preceded something of a ‘space

race’ among operators and their respective

investors. The initial clamour began in Central

London, in 2017, and has subsequently rippled

out to the UK’s other major centres.

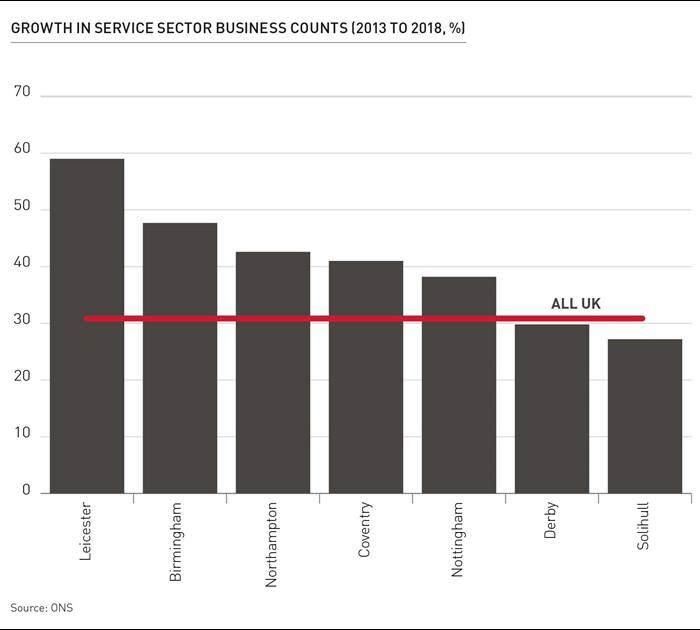

Birmingham itself is a prime target for expansive operators. The city boasts a higher rate of growth in service sector businesses than any other major UK city over the past five years and was second only to London for the number of new business start-ups in 2018.

This, alongside a stream of contract-led requirements in the city, is highly conducive to flexible office demand.

And it's still early days

Despite the scale of activity within

Birmingham lately, the growth of flex-space

is off a relatively low base. LSH Research

reveals that while Birmingham is home to the

highest proportion of flex-space among the

region’s key markets, equivalent to 2.5% of

total stock, this is relatively low when viewed

in context with the UK’s South East markets

(3.8%). Indeed, when WeWork’s recent

acquisitions become operational, it will merely

take Birmingham into line with the South East.

There is clearly headroom for growth.

Contrasting occupancy rates

While Birmingham’s scale and positive

attributes merit the attention it has received,

the region’s other key markets should not be

dismissed out of hand. The variation in both

current levels of flex-space provision and

prevailing levels of occupancy should be an

important consideration to both landlords

considering more flexible leasing offers and

serviced office operators seeking to exploit

gaps in the market.

Occupancy levels vary widely between locations; Nottingham and Coventry’s total flexi-space offering currently enjoys a 90% occupancy rate, some way ahead of Birmingham city centre’s which currently stands at only 69%. Meanwhile, with growth of 60% in just five years, Leicester has seen one of the strongest rates of business count growth of anywhere in the UK, which ought to bode well for the demand for flexible solutions.

A wake-up call for landlords

WeWork’s current troubles are well documented but with plenty more serviced office

requirements set to enter the markets, the

recent activity we have seen is no flash in the

pan. So, should landlords of conventional

offerings be concerned?

The tides of structural change will see

more and more occupiers, particularly

at the smaller end of the market, turn to

flexible offerings. Indeed, recent take-up

in Birmingham revealed a thinning of

traditional leasing activity in the sub 5,000

sq ft category, not because of a downturn

in demand per se but rather a transition of

demand from conventional leased offices to

new high quality flex space offerings.

While traditional serviced offices typically lack the wow factor, the new wave of flex space operations are raising the bar in quality, in terms of design, appeal and amenity provision. Landlords of more conventional offices have to adapt their own offerings to meet the growing appetite for an office to reflect a more holistic, aspirational lifestyle that extends beyond only the functional need for space.

Download a copy of our Midlands Office Market Report 2019.

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email