Strong Q3 figures continue to drive very positive results.

Strong Q3 figures continue to drive very positive results

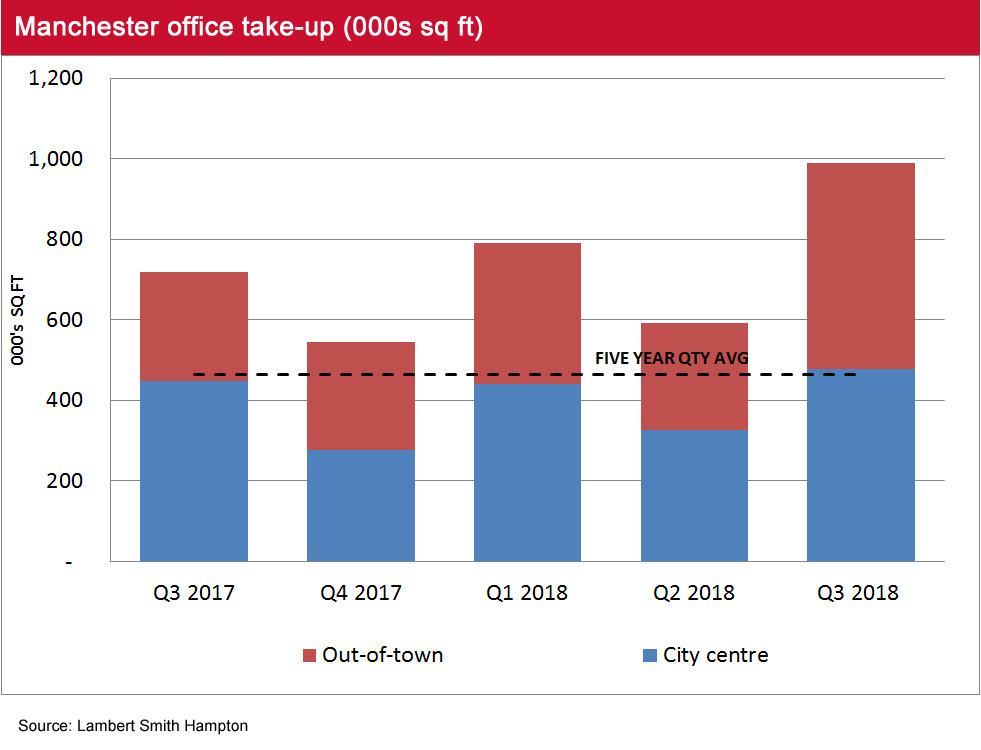

- City centre office take-up for Q3 2018 reached 479,637 sq ft across 64 transactions, a 7% increase on the same quarter in 2017. This brings the total for 2018 to 1.24m an impressive 32% greater than this point last year.

- The uplift was largely due to the pre-let to Booking.com of 220,000 sq ft. The lack of available grade A space has affected take up, and this trend will continue into 2019.

- In the out of town markets, take-up was high in both Salford Quays and Trafford with a combined take-up of 148,000 sq ft for Q3, bringing the 2018 total to 270,643 sq ft which is a 30% increase on the same period in 2017. The largest deal in Q3 was the sale of the Kelloggs HQ (86,000 sq ft) to Trafford Council for the UA92 University.

- South Manchester also enjoyed a fruitful quarter, with 279,931 sq ft transacting, bringing the 2018 total to 658,196 sq ft, a 40% increase on the same period in 2017. The largest deal was the sale of Park House (140,000 sq ft) at Alderley Park Business Park to Royal London.

- Warrington saw a Q3 total of 83,317 sq ft bringing the current total to 280,800 sq ft, an increase of 35% over the same period in 2017.

Occupier appetite has not diminished

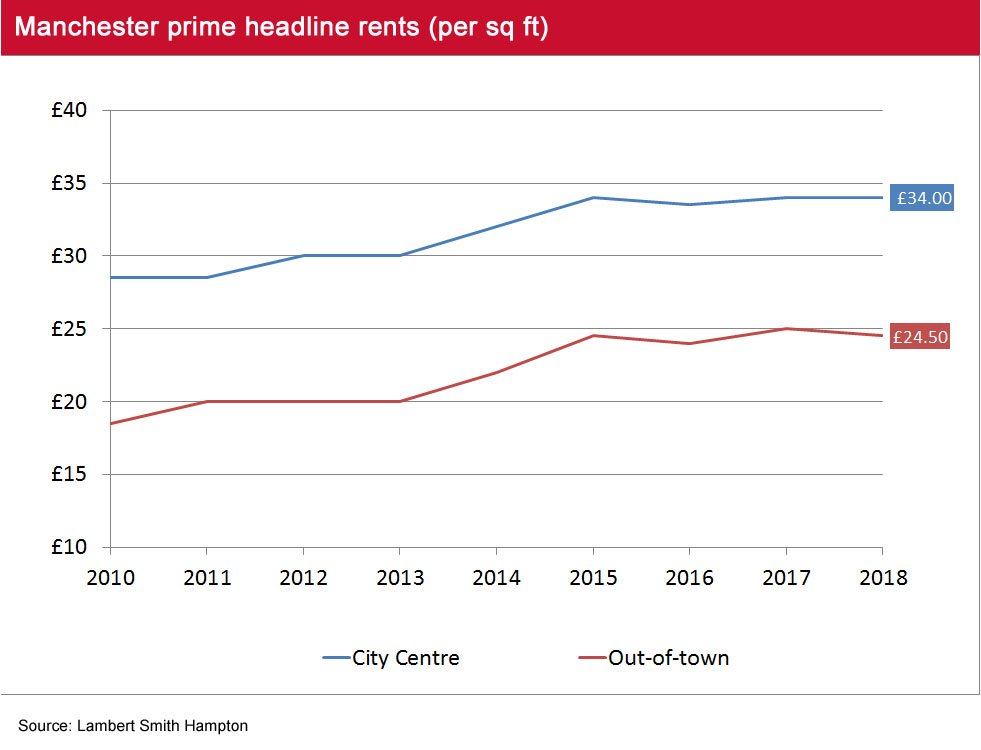

- Occupier appetite for both new build and refurbished grade A product has not diminished, with average rents moving towards £24.00 per sq ft and pre-let rents likely to be at £35.00 per sq ft in the near future.

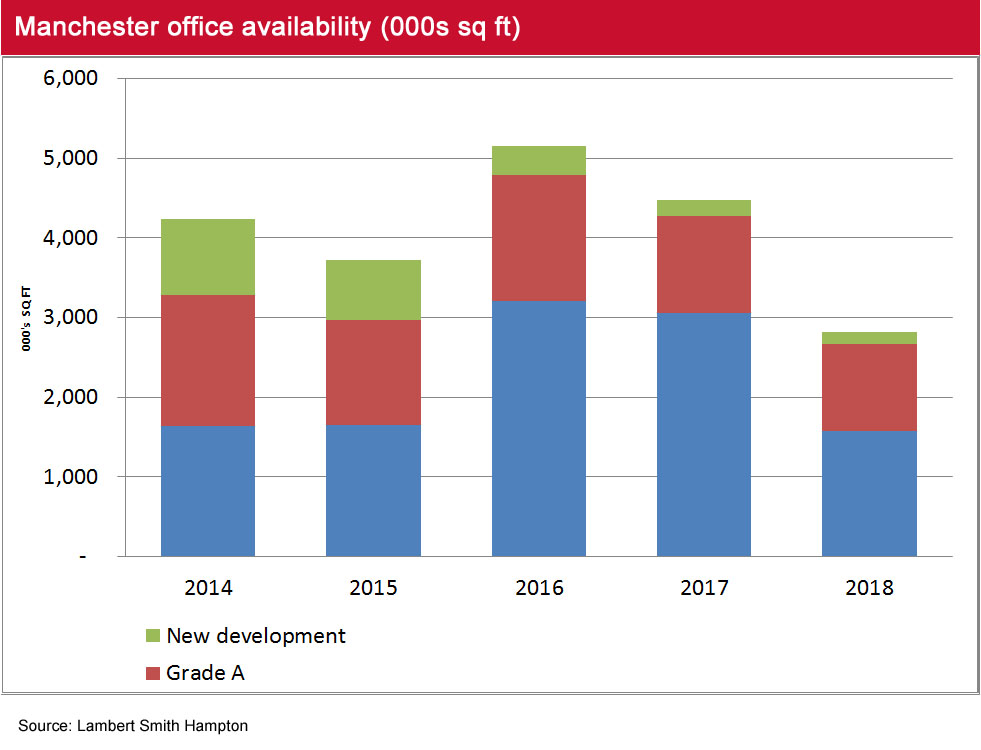

- Grade A new build supply continues to dwindle, with limited new development being delivered. A number of refurbished schemes will be going live this year and it is inevitable that pre-lets will be the order of the day in 2019.

Key occupational transactions

| Property | Size (sq ft) | Landlord(s)/vendor | Tenant |

| Goods Yard, St Johns | 220,000 | Allied London | Booking.com |

| Alderley Park | 140,000 | Bruntwood | Royal London |

| 8 First Street | 26,000 | Patrizia | Odeon |

| Epsom House | 22,669 | Orbit | Pets At Home |

| ABC, Quay Street | 22,550 | Allied London | Farm Group |

Source: Lambert Smith Hampton

Upward pressures on prime secondary rents continues

- The highest rent achieved within the city centre this quarter was at 3 Hardman Square at £32.50 per sq ft to ‘In Touch Network’ (over 22,032 sq ft).

- At the grade A refurbished schemes, 82 King Street and 4 Hardman Square, £32.00 per sq ft was achieved.

- Headline rents and secondary refurbished rents are expected to rise throughout next year as the new build grade A supply decreases and new refurbished product goes onto the market.

- The highest out of town rent was again seen at the Orange Tower at MediaCityUK at £24.50 per sq ft, although rents of £25.00 per sq ft at Airport City have also been reported.

- Due to the limited supply of grade A space, incentive packages remain low with an average package of 9-12 months rent-free being offered for a five-year term certain.

Investment activity

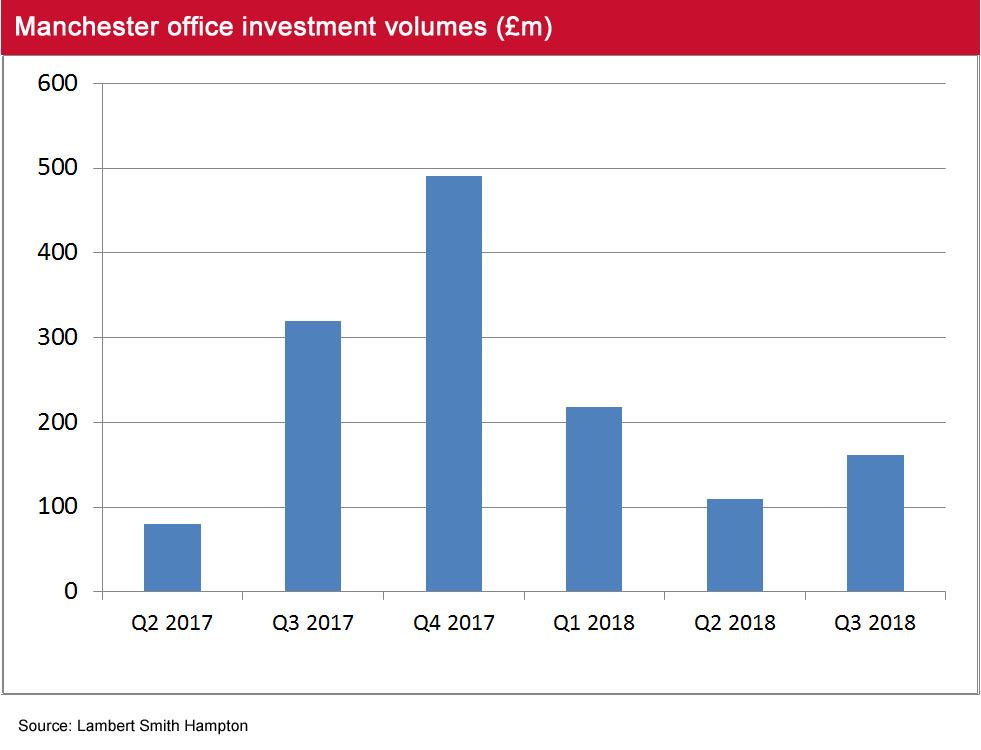

- Greater Manchester office investment activity totalled £161m in Q3 2018.

- The total, spread over 13 transactions, was up £52m on the previous quarter but down £158m year-on-year.

- Total office investment in the Manchester city centre sub-market was £73m across six transactions, accounting for 45% of the total volume.

- The most notable deal was the £54m purchase of Manchester Business Park by Dimah Capital from TPG Real Estate, reflecting a net initial yield of 6.13%.

- Key office deals in the city centre included Harmsworth Pooled Property Unit Trust’s purchase of 71 King Street for £18m and The Observatory which was purchased by Artmax Properties for £20m.

- Despite strong investor demand for office assets in Greater Manchester, a lack of stock has resulted in a lower than average investment volume.

Key investment transactions

| Property | Value (£m) | Investor | Vendor |

| Manchester Business Park | 54 | Dimah Capital | TPG Real Estate |

| The Observatory | 20 | Artmax Properties | USS |

| 76 King Street | 18 | Harmsworth Pooled Property Unit Trust | Aprirose REI |

Source: Lambert Smith Hampton

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email