Amid all the uncertainty in the lead up to December’s election, investment into the UK industrial sector hit an impressive £2.1bn in Q4 2019. In context, this is 27% above the five year quarterly average and marks only the fifth occasion where quarterly industrial volumes surpassed £2bn.

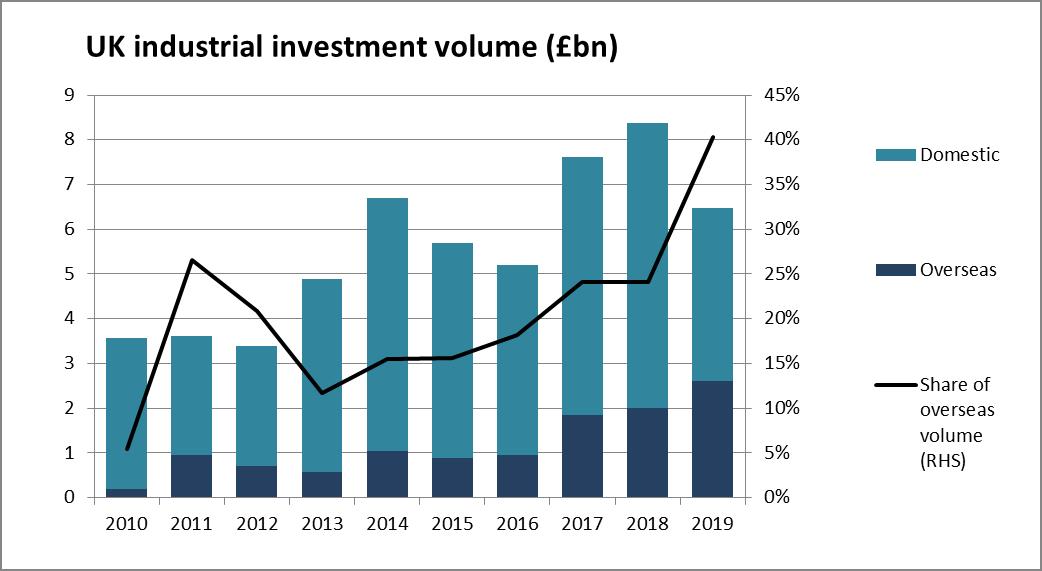

While total industrial volume in 2019 fell 23% short of 2018’s record, the scale of overseas activity was particularly striking. Overseas buyers invested a record £1.2bn into industrial in Q4, in the process capping a record year for overseas buying in the sector – at £2.6bn for 2019 as a whole.

Overseas buyers dominated at the larger end of the market in Q4 2019, responsible for each of the six largest deals and accounting for 59% of total volume. This included three deals in excess of £100m, namely Morgan Stanley RE’s £241m purchase of the Tudor Portfolio (NIY 3.9%), Starwood Capital’s £200m purchase of the UK Urban Industrials Portfolio and Deka-Immobilien’s £145m purchase and leaseback acquisition of the B&M Bargains warehouse, Bedford (NIY 4.5%).

Traditionally the mainstay of industrial investment, domestic buyers showed greater caution towards the sector in 2019. Domestic purchasing of UK industrial was £3.9bn in 2019, its lowest annual total since 2012. This is linked to a number of factors, including elevated uncertainty, high pricing levels associated with the sector and concerns over redemptions among many of the UK funds linked to Brexit.

Alex Carr, Head of Industrial Investment at Lambert Smith Hampton, commented:

“The scale of overseas buying in 2019 is testament to both the ongoing attraction of UK real estate and the favourable dynamics associated with the industrial sector specifically. While prime yields across the sector are rooted at all-time lows, in a global context the sector continues to offer relative value.”

“Last December’s decisive election result has delivered a much-needed dose of certainty to the market, at least in the short term, and we expect a restoration of activity from domestic buyers. Even if the returns are not on the same level as we’ve seen in recent years, the sector is set to continue to outperform the wider market in 2020, and as a result we expect volume in 2020 to come close to 2018’s record level of £8.4bn.”

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email