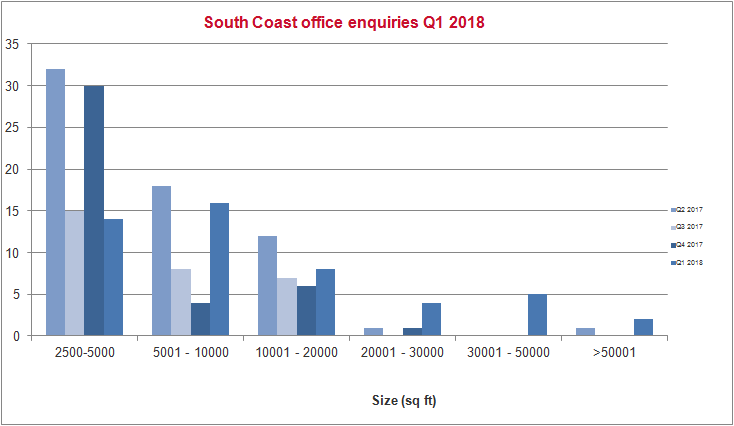

Enquiry levels however did recover and were 20% higher than those received in Q4 2017. There was also a 22% increase in the number enquiries over 10,000 sq ft (39% of all enquiries). Supply remained stable, increasing by only 4% to 1,023,689 sq ft.

Q1 2018 saw transactional volume hit nearly £100m; 80% of which was attributable to Internos’s purchase of the NATS building located at Solent Business Park for c.£83m reflecting a NIY of 5.2%. Other activity at the park included Wesleyans acquisition of Leander House let to Northrop Grumman UK Limited for a term certain of 5 years at a rent of £755,000 (c.£16.90 psf). The final agreed price was £7.36m reflecting a NIY of 9.60%.

Enquiry levels increase by 20%

Enquiry levels (>2,500 sq ft) increased by 20% from Q4 and were in line with average enquiry numbers for the past 3 years. There was a significant reverse in the 2017 trend of smaller enquiries with only 14 enquiries below 5,000 sq ft when compared to 30 enquiries in the same size bracket in the previous quarter. 22% of all enquiries were over 20,000 sq ft including two above.

Take-up falls to lowest level in 5 years

Significant occupational transactions

| Property | Size (sq ft) | Vendor/Landlord | Tenant/Purchaser | Rent (£/sq ft) | Term |

| Forum 5, Solent Business Park, Fareham | 12,500 | Tristan Capital | Shoosmiths | £18.50 | 10 |

| Director General's House, Southampton | 8,722 | C&G | The Workstation | £18.00 | 10 |

| Building 6000, Langstone Technology Park, Havant | 6,065 | Trinity IM | Battelle | £14.00 | 10 |

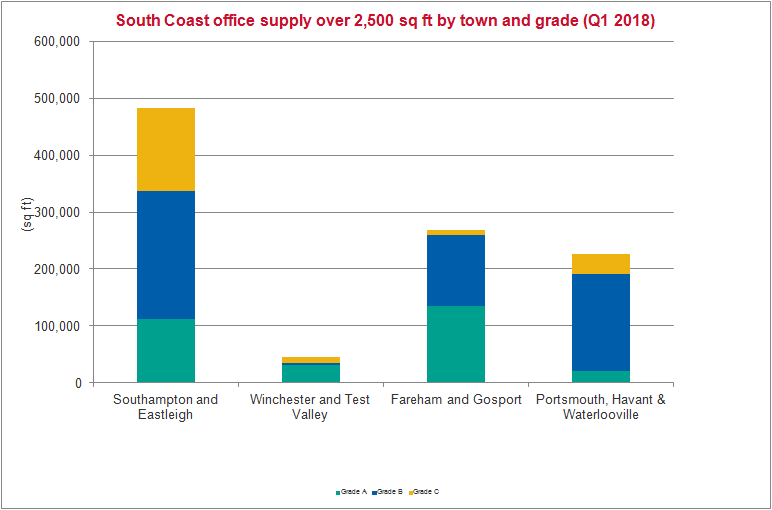

Supply makes a slight increase in Q1

Supply slightly increased by 4% to 1,023,689 sq ft. The greatest increase in availability (albeit relatively insignificant) is in the city centre. Grade A supply at 299,683 sq ft increased to stand at 29% of total supply. This increase is exclusively as a result of refurbishments of existing office stock. There were no new offices built throughout the whole of 2017 (there will be 20,850 sq ft completed at Chilcomb Park, Winchester later in 2018).

Rents remain stable

City centre opportunities attracting investor interest

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email