Enquiries Rise By 25%

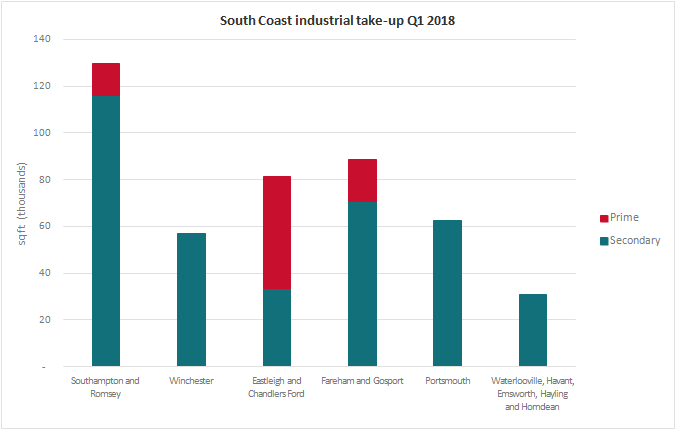

14% Increase In Take-up

| Q1 2018 (sq ft) | Q4 2017 (sq ft) | % change | % change Year on Year | |

| Total take up | 450,627 | 394,005 | 14.37% | 4.11% |

| Prime take up | 79,406 | 143,514 | -44.67% | 3.72% |

| Secondary take up | 371,221 | 250,491 | 48.2% | 4.19% |

Significant occupational transactions

| Size | Landlord | Tenant | Terms | Rent/Price (per sq ft) | |

| Detached Factory, Moorside Road, Winchester | 49,780 sq ft | La Salle | Apen Components Ltd | TBC | £5.75 |

| Unit 2 Alpha Park, Chandlers Ford | 44,868 sq ft | Blackrock | Charles Kendall Freight Ltd | 10 yr lease | £10 |

| Units 220-230 Fareham Reach, Gosport (LSH/HL) | 38,000 sq ft | Britel Fund Trustees Limited | Ashford Colour Press | 15 yr lease | £7.03 |

| Unit 1 Mauretania Road, Nursling | 21,633 sq ft | CBREGi | Aqua Pacific UK | 5 yr lease | £8.25 |

| Unit 1-3 Southmoor Lane, Havant | 18,582 sq ft | Guinness Partnership Group | Monolution Holdings | Sale | £67.94 |

| Unit 1 (Club Hangar) Solent Airport Daedalus | 6,350 | FBC | Bournemouth Avionics | 6 yr lease | Confidential |

| Unit 2 (Club Hangar) Solent Airport, Daedalus | 6,350 | FBC | Bournemouth Avionics | 6 yr lease | Confidential |

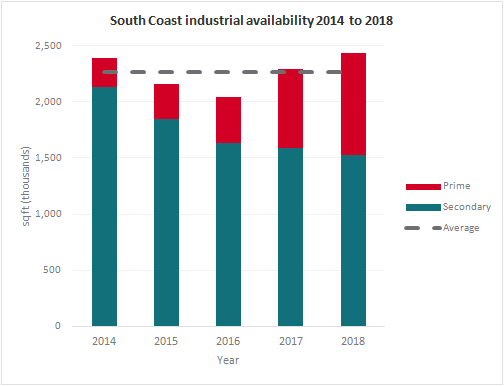

Rise In Speculative Development

2017 saw a rise in new speculative development coming out of the ground both for speculative builds and units with pre-lets agreed, and there is more to come. New development in the region has risen significantly and as such, these sites are now either built, or are nearing completion. Notable new stock includes Units 4 and 7 at Mount Park totalling 173,890 sq ft and Units 1 & 2 South Central, Nursling totalling 155,970 sq ft.

Secondary stock availability has slightly declined however the year on year figure indicates this is being maintained at a relatively consistent level; a trend we anticipated to continue at the end of last year with tenants remaining in their current premises.

We note from our statistics that where there has been some change in tenant’s occupation is where business has suffered and occupiers have gone into administration. Notable stock which has come back to the market due to this factor includes Radial 27, Unit 3 Crompton Way and Brooklands Courtyard totalling 125,970 sq ft.

The vital statistics have been summarised below:

| Q1 2018 (sq ft) | Q4 2017 (sq ft) | % change | % change Year on Year | |

| Total stock | 2,433,300 | 2,293,412 | 6.1% | 13.59 |

| Prime stock | 907,227 | 709,904 | 27.8% | 69.71 |

| Secondary stock | 1,526,073 | 1,583,508 | -3.63% | -5.07 |

Double Digits Reached

Investment Market Review

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email